Self Employment Printable Small Business Tax Deductions Worksheet

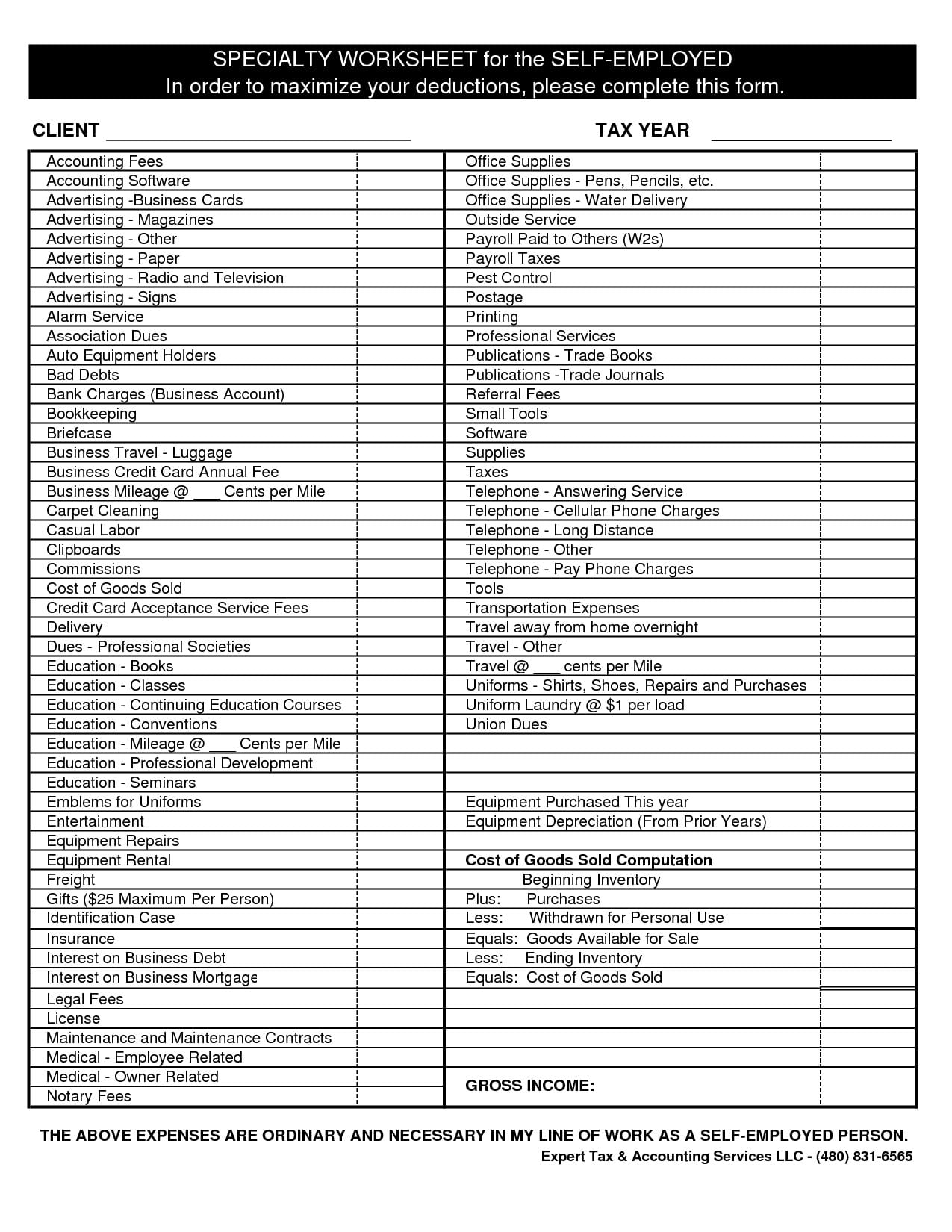

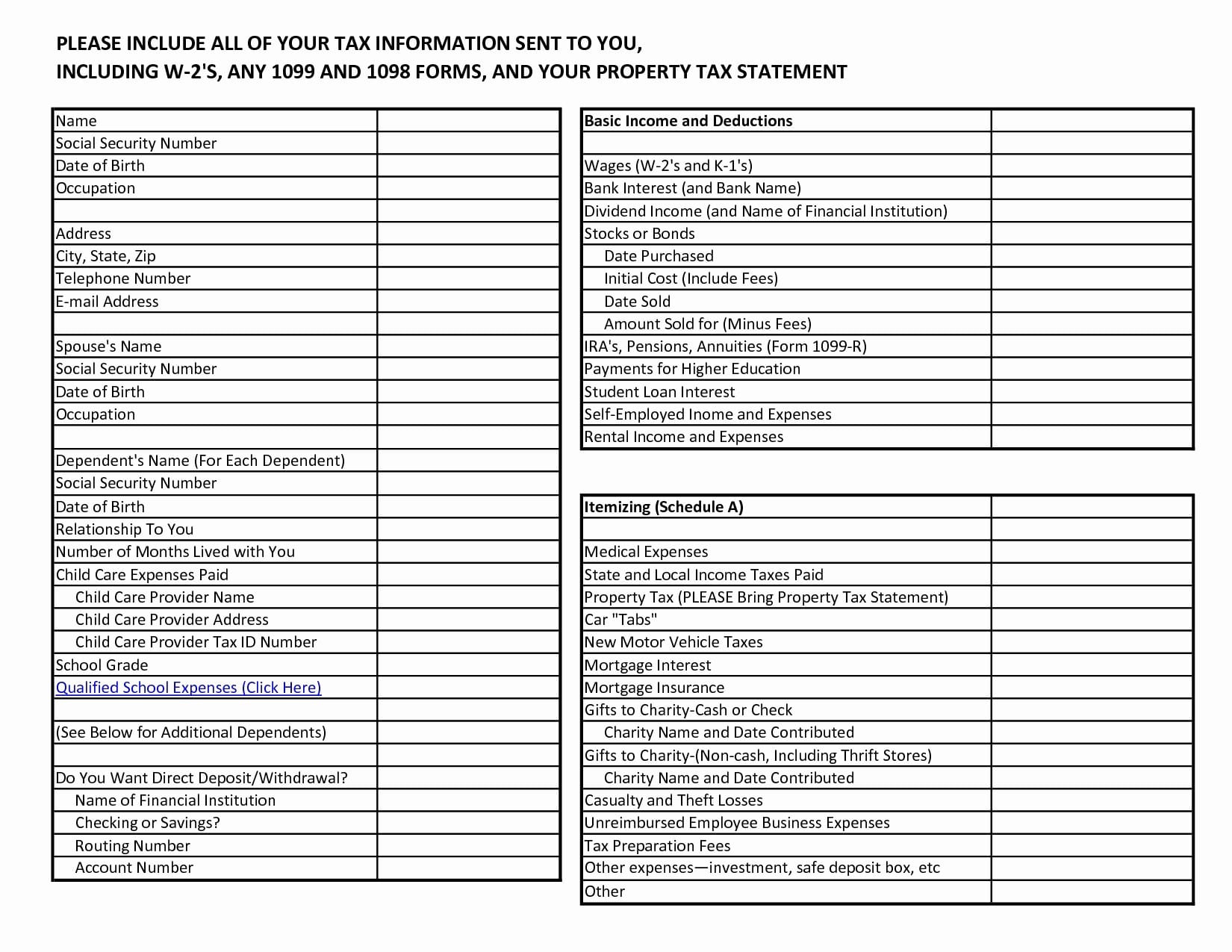

Self Employment Printable Small Business Tax Deductions Worksheet - Web reimbursements for business expenses. Web tax organizer the self‐employed tax organizer should be completed by all sole proprietors or single member llc owners. Signnow allows users to edit, sign, fill and share all type of documents online. Web employment tax forms. You pay 12.4% on the first $147,000 of income for social security tax, and 2.9% for medicare tax on your total. Schedule e (form 1040) to report rental real estate and royalty income or. Ad easy to run payroll, get set up & running in minutes! Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig. The rate consists of two parts: Member llc and sole proprietors. It has been designed to help collect and. Know where you can save money and grow your profits. You pay 12.4% on the first $147,000 of income for social security tax, and 2.9% for medicare tax on your total. Web tax organizer the self‐employed tax organizer should be completed by all sole proprietors or single member llc owners. Web unemployment. Web reimbursements for business expenses. Know where you can save money and grow your profits. Web employment tax forms. Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. You pay 12.4% on the first $147,000 of income for social security tax, and 2.9% for medicare tax on your total. Web reimbursements for business expenses. Member llc and sole proprietors. Signnow allows users to edit, sign, fill and share all type of documents online. Know where you can save money and grow your profits. Schedule e (form 1040) to report rental real estate and royalty income or. Supplemental income (rental) excise taxes. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Member llc and sole proprietors. You pay 12.4% on the first $147,000 of income for social security. Member llc and sole proprietors. Signnow allows users to edit, sign, fill and share all type of documents online. Web reimbursements for business expenses. You pay 12.4% on the first $147,000 of income for social security tax, and 2.9% for medicare tax on your total. Supplemental income (rental) excise taxes. Web unemployment tax (futa), state unemployment (sui) and state training tax (ett). Ad easy to run payroll, get set up & running in minutes! Web reimbursements for business expenses. You can reduce your business income by a chunk. Web tax organizer the self‐employed tax organizer should be completed by all sole proprietors or single member llc owners. Web schedule a (form 1040) to deduct interest, taxes, and casualty losses not related to your business. Ad deductions checklist & more fillable forms, register and subscribe now! Member llc and sole proprietors. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. You pay. Know where you can save money and grow your profits. Web 50 %off for 12 months. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. You can generally deduct the amount you pay or reimburse employees for business expenses incurred for your business. Member. You pay 12.4% on the first $147,000 of income for social security tax, and 2.9% for medicare tax on your total. Web tax organizer the self‐employed tax organizer should be completed by all sole proprietors or single member llc owners. Web unemployment tax (futa), state unemployment (sui) and state training tax (ett). • use schedule c to calculate whether your. Schedule e (form 1040) to report rental real estate and royalty income or. Web tax organizer the self‐employed tax organizer should be completed by all sole proprietors or single member llc owners. Web schedule a (form 1040) to deduct interest, taxes, and casualty losses not related to your business. Web employment tax forms. You can reduce your business income by. Ad easy to run payroll, get set up & running in minutes! Know where you can save money and grow your profits. Web employment tax forms. You pay 12.4% on the first $147,000 of income for social security tax, and 2.9% for medicare tax on your total. Web unemployment tax (futa), state unemployment (sui) and state training tax (ett). Member llc and sole proprietors. You can generally deduct the amount you pay or reimburse employees for business expenses incurred for your business. Web schedule a (form 1040) to deduct interest, taxes, and casualty losses not related to your business. • use schedule c to calculate whether your business had a taxable profit or a deductible. Web 50 %off for 12 months. It has been designed to help collect and. The rate consists of two parts: Supplemental income (rental) excise taxes. Web reimbursements for business expenses. Signnow allows users to edit, sign, fill and share all type of documents online. Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig. Web tax organizer the self‐employed tax organizer should be completed by all sole proprietors or single member llc owners. Use separate sheet for each business. Ad deductions checklist & more fillable forms, register and subscribe now! Schedule e (form 1040) to report rental real estate and royalty income or.Self Employed Tax Deductions Worksheet Form Fill Out and Sign

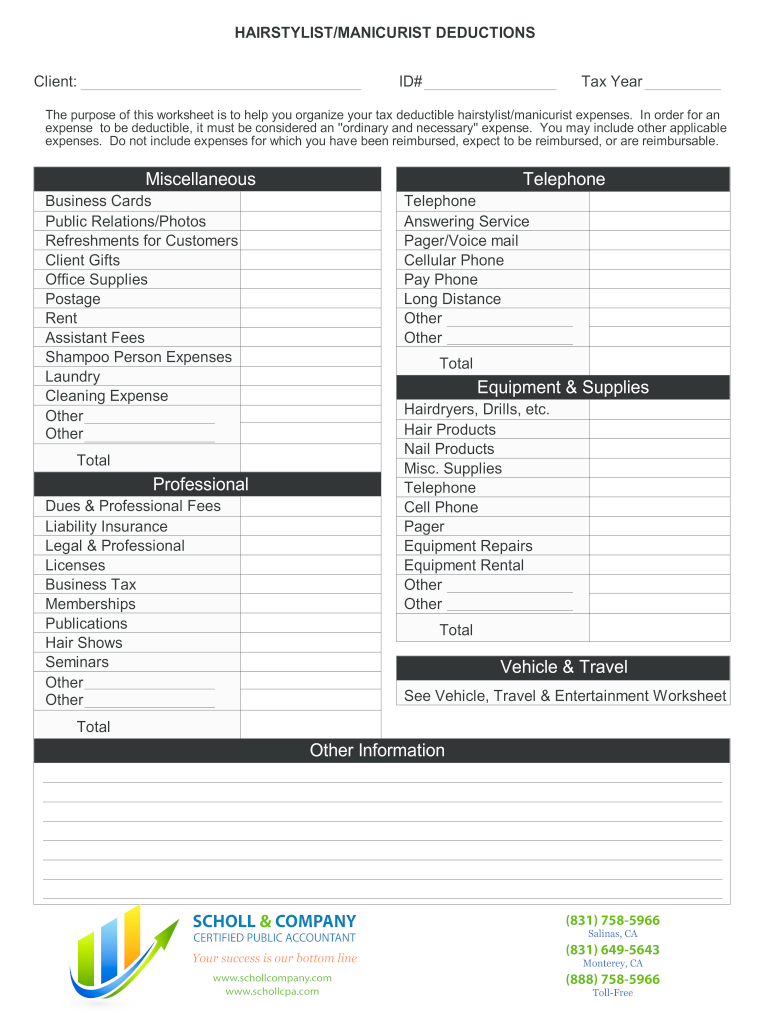

Self Employed Tax Deductions Worksheet —

2017 Self Employment Tax And Deduction Worksheet —

Self Employment Printable Small Business Tax Deductions Worksheet

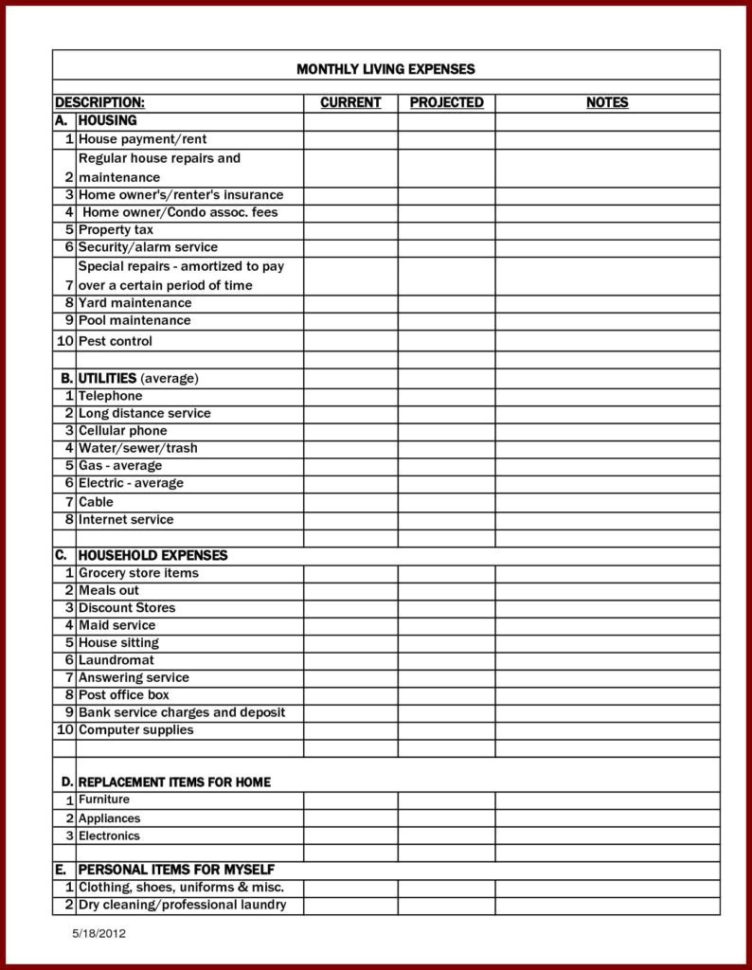

Small Business Tax Deductions Worksheet

Self Employment Printable Small Business Tax Deductions Worksheet

Schedu Small Business Tax Deductions Worksheet Perfect Times —

Self Employment Printable Small Business Tax Deductions Worksheet

Anchor Tax Service Self employed (general)

Self Employment Printable Small Business Tax Deductions Worksheet

Related Post: