Printable Sales Tax Chart

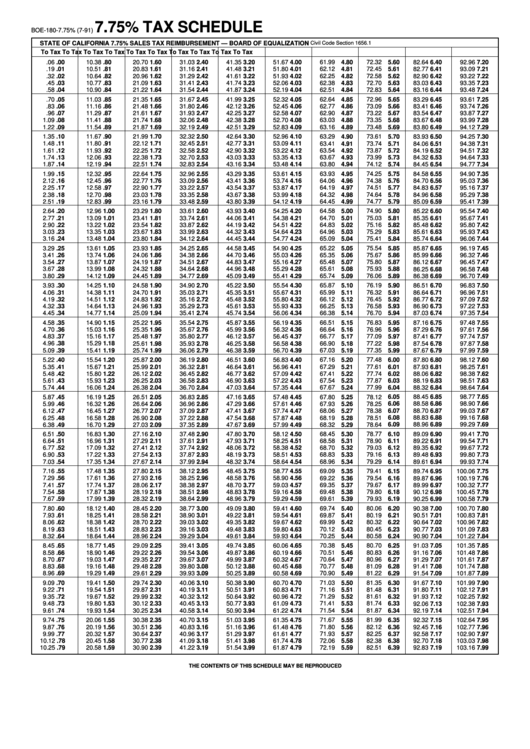

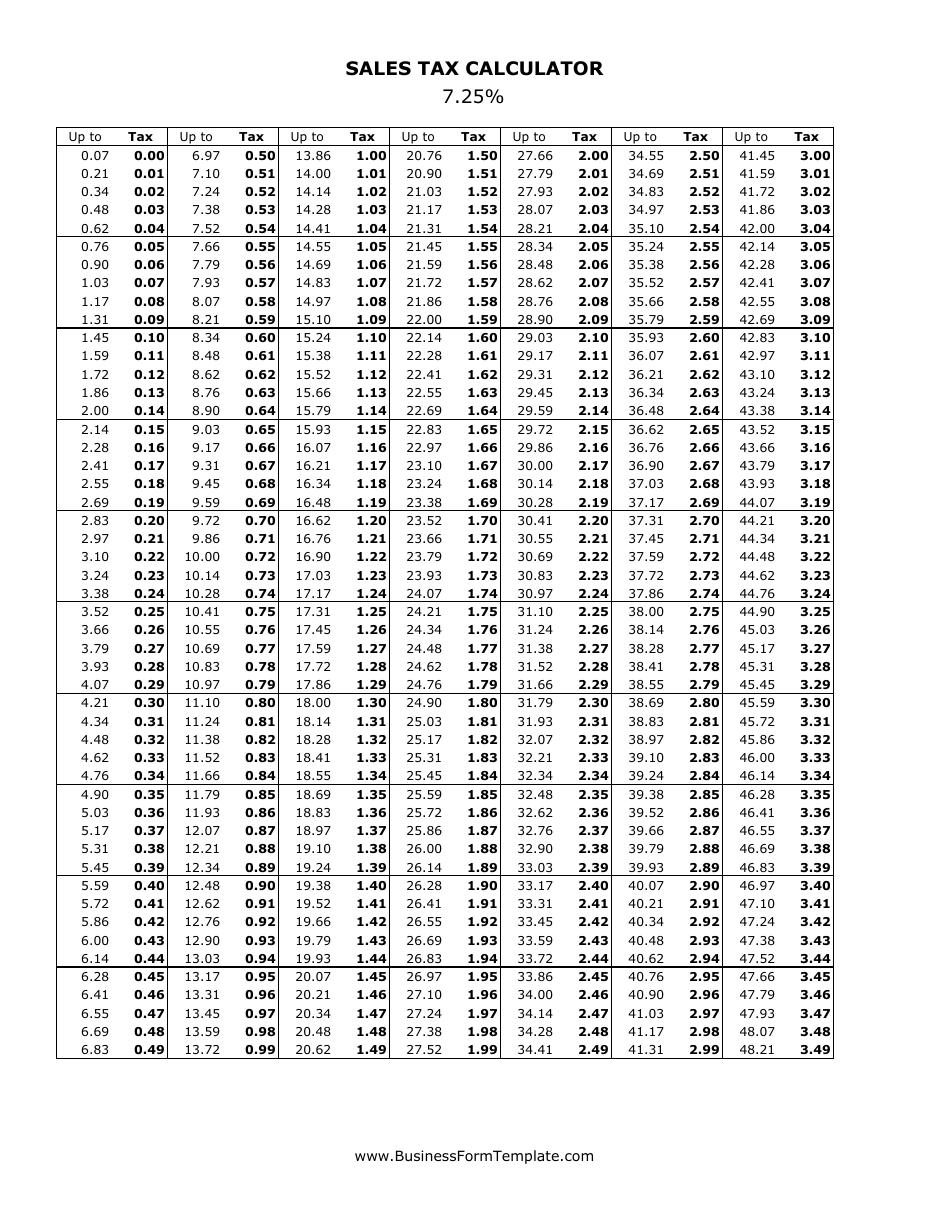

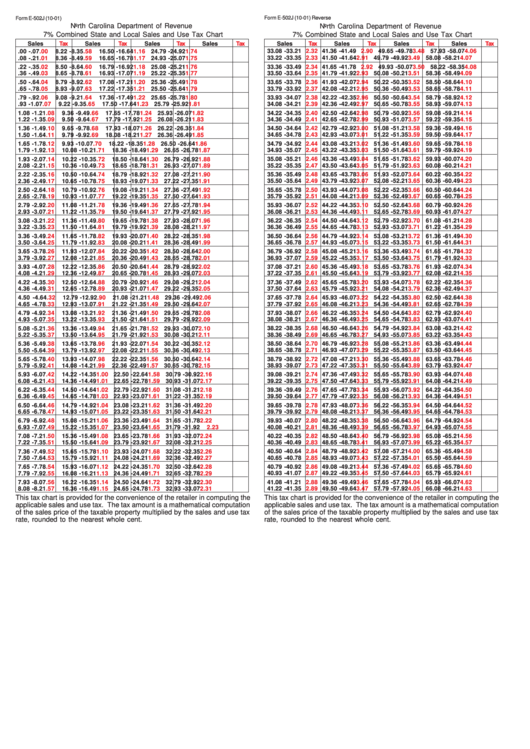

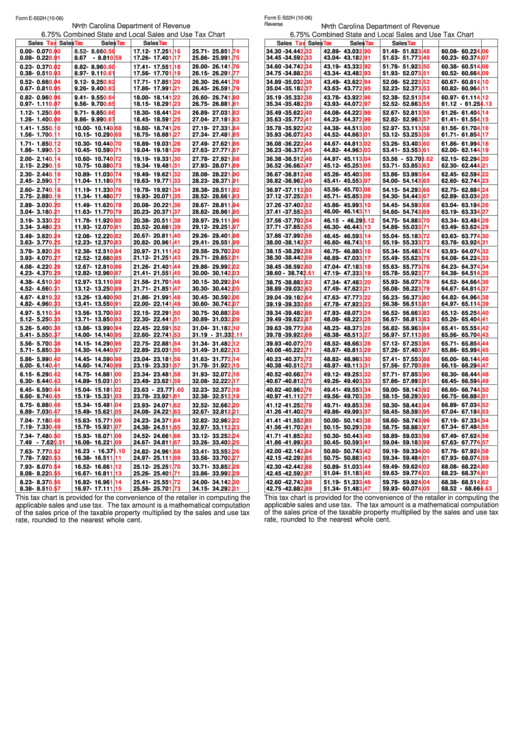

Printable Sales Tax Chart - A sales tax chart can be used to quickly determine how much tax is owed for a purchase of a given price. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Tax and earned income credit tables. If you are looking for additional detail, you may wish to utilize the sales. Combining local tax (2.75%) and state tax (7%) = total (9.75%). Web the five states with the highest average combined state and local sales tax rates are louisiana (9.55 percent), tennessee (9.547 percent), arkansas (9.48 percent),. Web retail sales tax rate charts. This step is about your income and any nontaxable items on your tax return. Web printable 4.3% virginia sales tax table. Estimate your state and local sales tax deduction. This booklet only contains tax and earned income credit tables from the instructions for. Simply enter your state's sales and use tax rate in the form below, and click on the click here to generate sales tax. Web the 8.6% sales tax rate in phoenix consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.3% phoenix. Estimate your state and local sales tax deduction. Sales and use tax rates & other information. Take control over your company's tax strategies and confidently manage with onesource®. Web the 8.6% sales tax rate in phoenix consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.3% phoenix tax. Ad calculate sales, use, & excise tax, vat,. Web download sales tax rate tables for any state for free. There is no applicable special tax. Web sep 27, 2022 cat. Web printable 4.3% virginia sales tax table. Take control over your company's tax strategies and confidently manage with onesource®. Combining local tax (2.75%) and state tax (7%) = total (9.75%). Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Estimate your state and local sales tax deduction. Web the sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions. Take control over your company's tax strategies and confidently manage with onesource®. Web printable 4.3% virginia sales tax table. Web retail sales tax rate charts. Web sales tax deduction calculator. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Web 51 rows generate a table. Web the 8.6% sales tax rate in phoenix consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.3% phoenix tax. Web download sales tax rate tables for any state for free. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Web printable 4.3%. Web retail sales tax rate charts. Get our configurable sales tax chart. Web the 8.6% sales tax rate in phoenix consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.3% phoenix tax. Web download sales tax rate tables for any state for free. Ad calculate sales, use, & excise tax, vat, & gst with our global. Tax and earned income credit tables. Web retail sales tax rate charts. Also, check the sales tax rates in different states of the u.s. Web sep 27, 2022 cat. Simply enter your state's sales and use tax rate in the form below, and click on the click here to generate sales tax. Take control over your company's tax strategies and confidently manage with onesource®. Sales and use tax rates & other information. If you are looking for additional detail, you may wish to utilize the sales. Tax rate tables delivered via email monthly to keep you up to date on changing rates. This step is about your income and any nontaxable items. Simply enter your state's sales and use tax rate in the form below, and click on the click here to generate sales tax. Web download sales tax rate tables for any state for free. Estimate your state and local sales tax deduction. Sales and use tax rates & other information. This step is about your income and any nontaxable items. Web 51 rows generate a table. Web the sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on schedule a. Tax rate tables delivered via email monthly to keep you up to date on changing rates. Sales and use tax rates & other information. This step is about your income and any nontaxable items on your tax return. Web retail sales tax rate charts. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Web the 8.6% sales tax rate in phoenix consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.3% phoenix tax. Take control over your company's tax strategies and confidently manage with onesource®. This booklet only contains tax and earned income credit tables from the instructions for. A sales tax chart can be used to quickly determine how much tax is owed for a purchase of a given price. Web taxes & forms. Web the five states with the highest average combined state and local sales tax rates are louisiana (9.55 percent), tennessee (9.547 percent), arkansas (9.48 percent),. Web download sales tax rate tables for any state for free. Combining local tax (2.75%) and state tax (7%) = total (9.75%). Tax and earned income credit tables. Get our configurable sales tax chart. Web printable 4.3% virginia sales tax table. Take control over your company's tax strategies and confidently manage with onesource®. There is no applicable special tax.Free Printable Sales Tax Chart Printable World Holiday

Printable Sales Tax Chart Printable World Holiday

7.25 Sales Tax Chart Printable Printable Word Searches

Printable Sales Tax Chart Konaka

Form E502j 7 Combined State And Local Sales And Use Tax Chart

Sales Tax by State Here's How Much You're Really Paying GOBankingRates

7.5 Sales and Use Tax Chart that is free to print and use. Chart

Form E502h 6.75 Combined State And Local Sales And Use Tax Chart

Free Printable Sales Tax Chart Printable World Holiday

Free Printable Sales Tax Chart Printable World Holiday

Related Post: