Printable Form 941

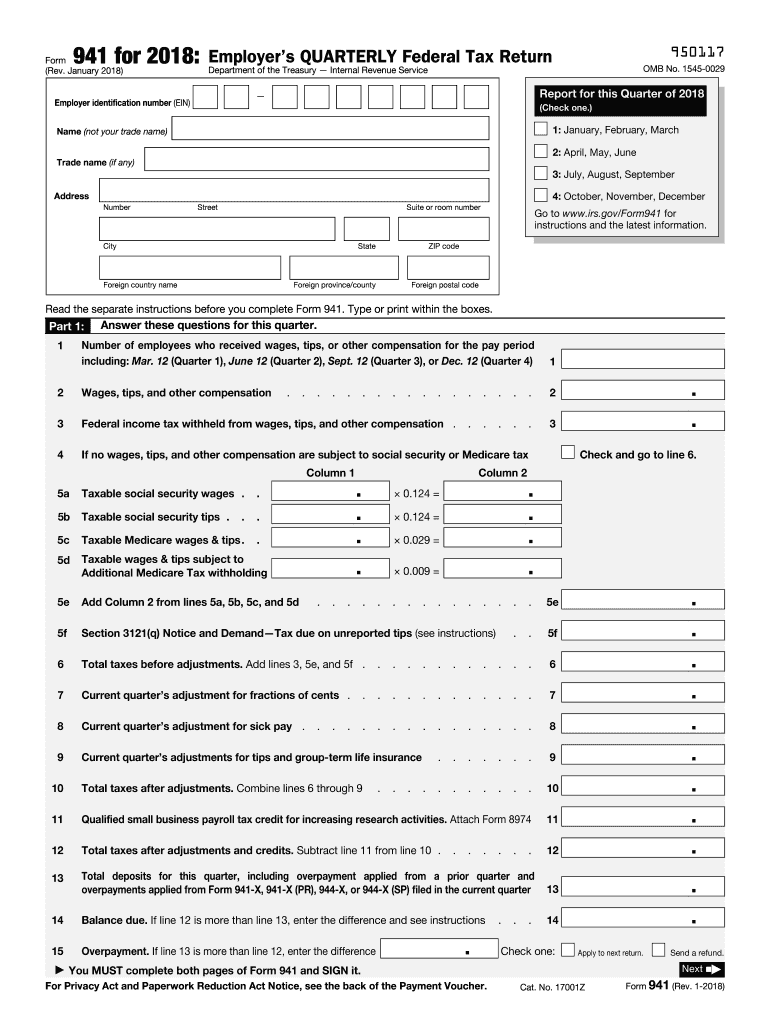

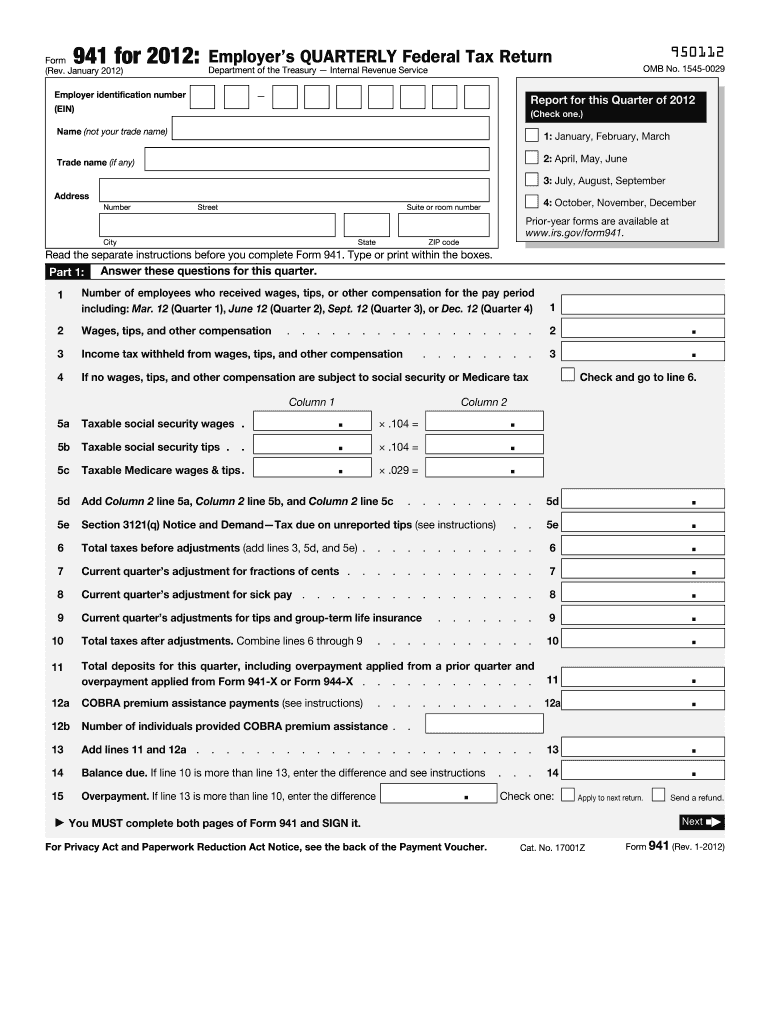

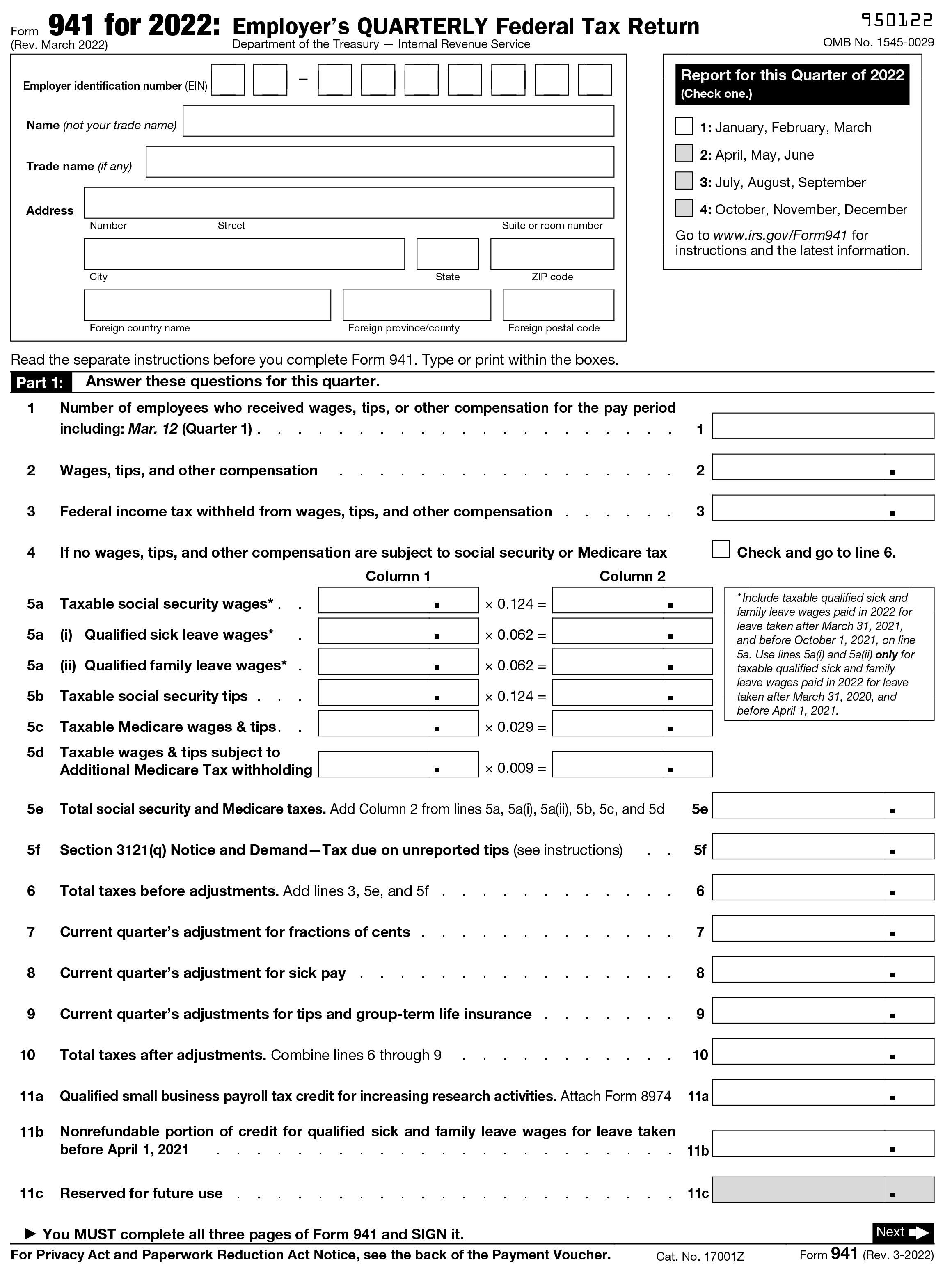

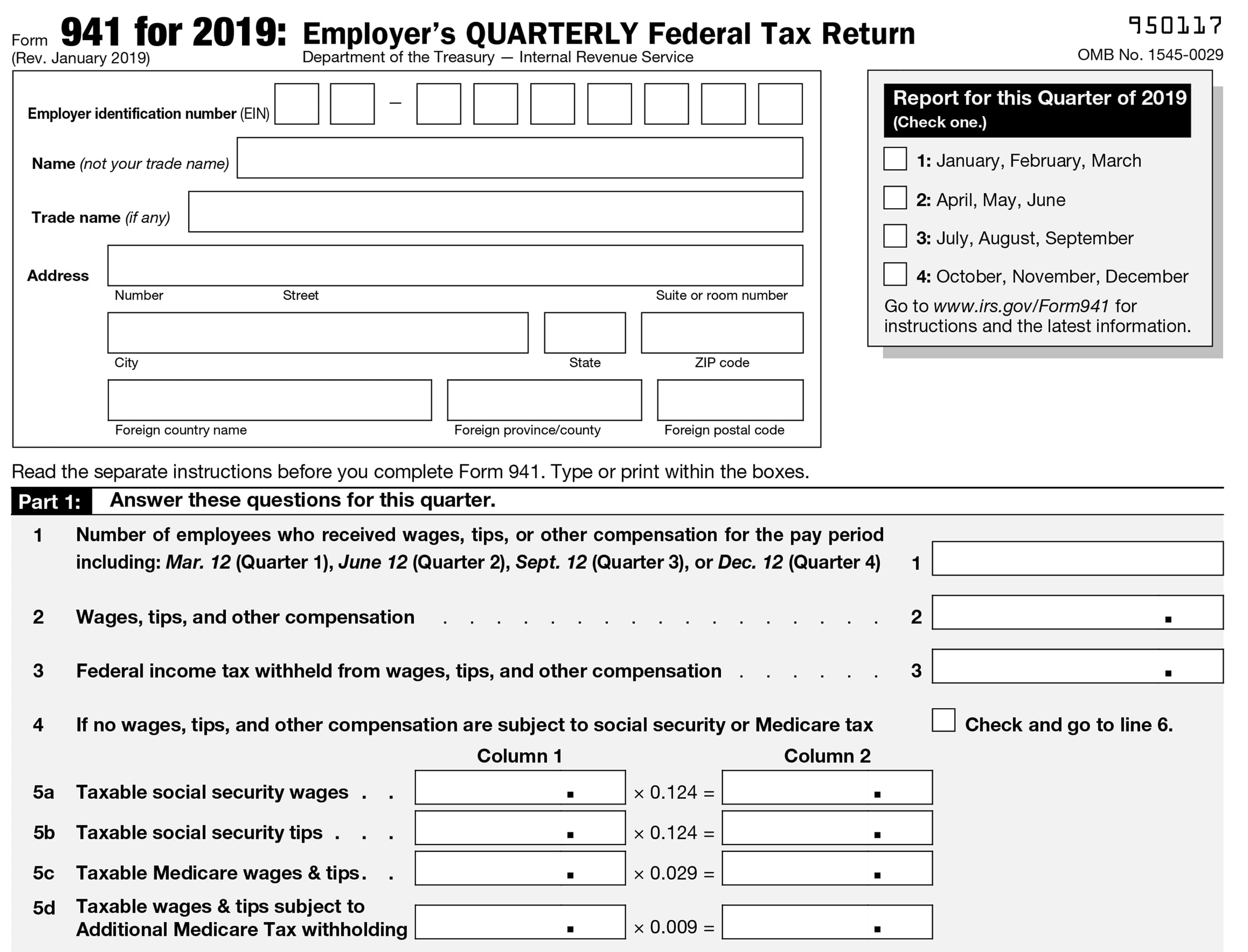

Printable Form 941 - Web form 941, employer's quarterly federal tax return; Ad printable 941 form for 2023. Answer these questions for this quarter. Web more about the federal form 941. Web the collectively bargained contributions paid by an eligible employer that are eligible for the credit are collectively bargained defined benefit pension plan contributions. Employer s quarterly federal tax return created date: Web 2022 form 941 author: How should you complete form 941? Don't use an earlier revision to report taxes for 2023. Web read the separate instructions before you complete form 941. Web purpose of form 941. For employers who withhold taxes from employee's paychecks or who must pay the. Web the collectively bargained contributions paid by an eligible employer that are eligible for the credit are collectively bargained defined benefit pension plan contributions. Web type or print within the boxes. October, november, december go to www.irs.gov/form941 for instructions and the latest. Web type or print within the boxes. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web the collectively bargained contributions paid by an eligible employer that are eligible for the credit are collectively bargained defined benefit pension plan contributions. Answer these questions for this quarter. We last updated federal form. You may use this web site and. Web the collectively bargained contributions paid by an eligible employer that are eligible for the credit are collectively bargained defined benefit pension plan contributions. Type or print within the boxes. Answer these questions for this quarter. Web use the march 2023 revision of form 941 to report taxes for the first quarter of. Answer these questions for this quarter. Ad easily create form 941 2016 with our template. Web type or print within the boxes. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Type or print within the boxes. Web more about the federal form 941. Web this eftps® tax payment service web site supports microsoft edge for windows, google chrome for windows and mozilla firefox for windows. October, november, december go to www.irs.gov/form941 for instructions and the latest. Web read the separate instructions before you complete form 941. At this time, the irs. Web form 941, employer's quarterly federal tax return; Number of employees who received wages, tips, or other compensation for the pay period including:. Type or print within the boxes. Answer these questions for this quarter. Web the collectively bargained contributions paid by an eligible employer that are eligible for the credit are collectively bargained defined benefit pension plan contributions. Answer these questions for this quarter. Web 2022 form 941 author: This form is for income earned in tax year 2022, with. At this time, the irs. Web form 941 (2021) employer's quarterly federal tax return for 2021. Web purpose of form 941. Type or print within the boxes. We last updated federal form 941 in july 2022 from the federal internal revenue service. 1 number of employees who. Don't use an earlier revision to report taxes for 2023. You may use this web site and. Web form 941 (2021) employer's quarterly federal tax return for 2021. Web this eftps® tax payment service web site supports microsoft edge for windows, google chrome for windows and mozilla firefox for windows. Web read the separate instructions before you complete form 941. At this time, the irs. This form is for income earned in tax year 2022, with. Web more about the federal form 941. Web this eftps® tax payment service web site supports microsoft edge for windows, google chrome for windows and mozilla firefox for windows. Type or print within the boxes. For employers who withhold taxes from employee's paychecks or who must pay the. 1 number of employees who. Answer these questions for this quarter. Web this eftps® tax payment service web site supports microsoft edge for windows, google chrome for windows and mozilla firefox for windows. Don't use an earlier revision to report taxes for 2023. Type or print within the boxes. Web read the separate instructions before you complete form 941. Answer these questions for this quarter. Ad easily create form 941 2016 with our template. This form is for income earned in tax year 2022, with. At this time, the irs. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web up to $40 cash back related to typeable 941 form 2016 941 form cat. Employer s quarterly federal tax return created date: How should you complete form 941? Web read the separate instructions before you complete form 941. Number of employees who received wages, tips, or other compensation for the pay period including:. 1 number of employees who. Type or print within the boxes. Web create a printable form 941 in a few simple steps 1 choose tax year and quarter 2 enter form 941 details 3 review your form 941 4 transmit your form 941 to the irs. Web 2022 form 941 author:2022 IRS Form 941 filing instructions and informations

EFile 941 at 3.99 Fillable Form 941 2019 Create 941 for Free

20212022 年版 IRS Form 941 (連邦給与税報告書フォーム) を記入する方法 PDF Expert

IRS 941 2010 Fill out Tax Template Online US Legal Forms

form 941 instructions Fill Online, Printable, Fillable Blank form

2021 941 Form Fill Out and Sign Printable PDF Template signNow

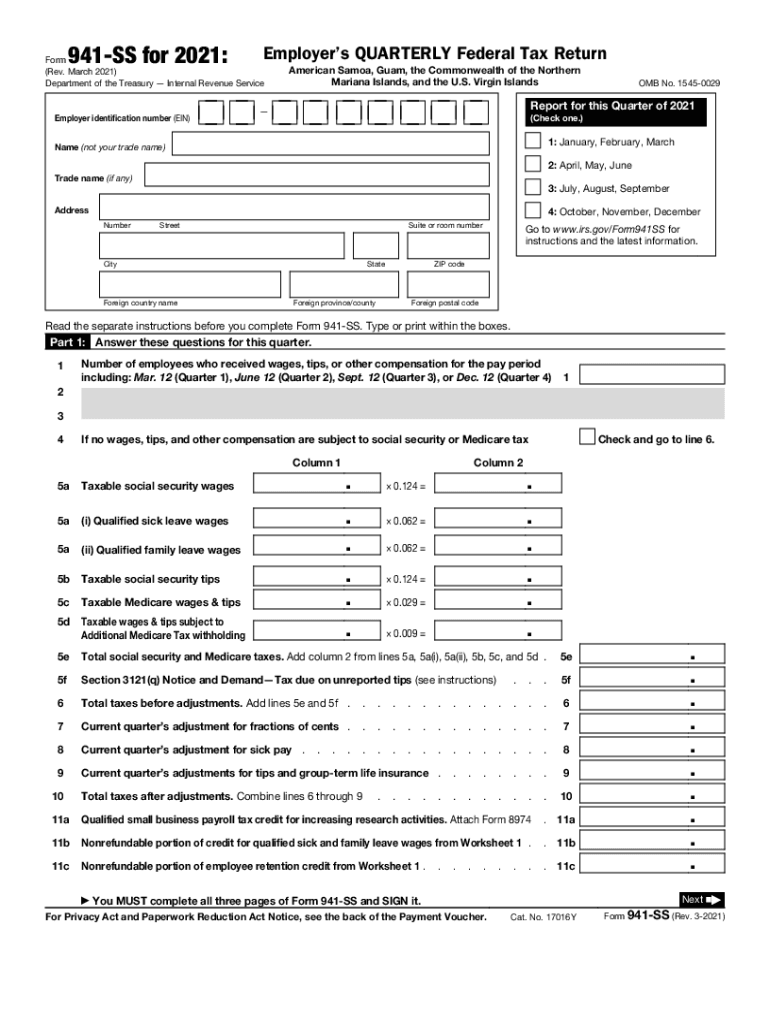

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

Form 941 Instructions & FICA Tax Rate [+ Mailing Address]

IRS 941 2018 Fill out Tax Template Online US Legal Forms

IRS 941 2012 Fill out Tax Template Online US Legal Forms

Related Post:

![Form 941 Instructions & FICA Tax Rate [+ Mailing Address]](https://fitsmallbusiness.com/wp-content/uploads/2018/12/word-image-1461.png)