Printable 1099 Nec

Printable 1099 Nec - For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Enter the total amount of the nonemployee compensation in the space provided. Enter the recipient's ssn or itin in the space provided. These “continuous use” forms no longer include the tax year. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web the official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is not. Select the vendors, then click continue. Quickbooks will print the year on the forms for you. Web you can print the 1099 nec form, charlenef. Review the form you want to print and select view selected 1099 contractors to confirm your contractors. The payment is made for services in the course of your trade or business. Web updated october 19, 2023. Enter the recipient's ssn or itin in the space provided. Furnish copy b of this form to the recipient by february 1, 2021. Used for the 2021 tax year only. Quickbooks will print the year on the forms for you. Enter the recipient's name in the space provided. A version of the form is downloadable and a fillable online pdf format is available on the irs website. Pdf *the featured form (2022 version) is the current version for all succeeding years. Furnish copy b of this form to the recipient. Used for the 2021 tax year only. Press the green arrow with the inscription next to jump from one field to another. Tap the print on 1099 forms button, then print to complete your printing. Quickbooks will print the year on the forms for you. Examples of this include freelance work or driving for doordash or uber. Furnish copy b of this form to the recipient by january 31, 2022. It's a relatively new addition to the fusillade of tax documents that go out. Web once the form is aligned, click next. Quickbooks will print the year on the forms for you. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099,. Used for the 2021 tax year only. Web updated october 19, 2023. You can complete the form using irs free file or a tax filing software. Web once the form is aligned, click next. It's a relatively new addition to the fusillade of tax documents that go out. Pdf *the featured form (2022 version) is the current version for all succeeding years. A penalty may be imposed for filing with the. Click get started for the 1099 form you want to create. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. You. Web once the form is aligned, click next. Used for the 2021 tax year only. File copy a of this form with the irs by february 1, 2021. Web you can print the 1099 nec form, charlenef. It's a relatively new addition to the fusillade of tax documents that go out. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Furnish copy b of this form to the recipient by february 1, 2021. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes.. A version of the form is downloadable and a fillable online pdf format is available on the irs website. Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. Press the green arrow with the inscription next to jump from one field to another. Businesses will use. Examples of this include freelance work or driving for doordash or uber. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Print and file copy a downloaded from this website; Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498. Web updated october 19, 2023. The payment is made for services in the course of your trade or business. Web once the form is aligned, click next. Enter the total amount of the nonemployee compensation in the space provided. Web the official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is not. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. A version of the form is downloadable and a fillable online pdf format is available on the irs website. It's a relatively new addition to the fusillade of tax documents that go out. Print and file copy a downloaded from this website; Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Enter the recipient's name in the space provided. Examples of this include freelance work or driving for doordash or uber. Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. Tap the print on 1099 forms button, then print to complete your printing. However, i recommend contacting our technical support team if the issue persists. Web to correct blank 1099 nec form 2021 printable version you should: Press the green arrow with the inscription next to jump from one field to another. Pdf *the featured form (2022 version) is the current version for all succeeding years. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. A penalty may be imposed for filing with the.1099 Nec Form 2020 Printable Customize and Print

1099 NEC Editable PDF Fillable Template 2022 With Print and Etsy

Printable 1099nec Form 2021 Customize and Print

How to File Your Taxes if You Received a Form 1099NEC

Form 1099NEC Instructions and Tax Reporting Guide

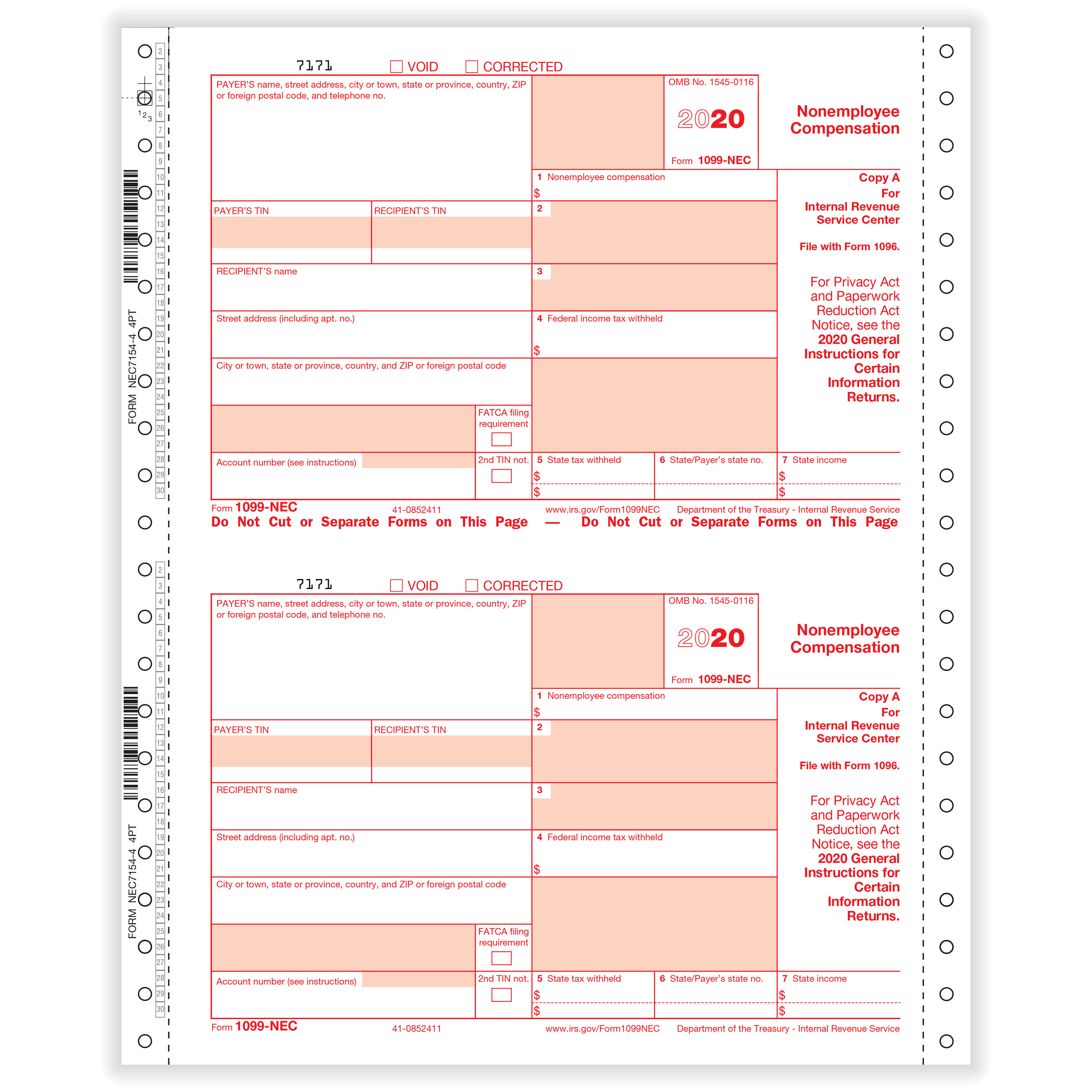

1099NEC Continuous 1" Wide 4Part Formstax

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

1099NEC Continuous 1" Wide 4Part Formstax

Form 1099NEC Nonemployee Compensation, IRS Copy A

Related Post: