Printable 1040 Sr

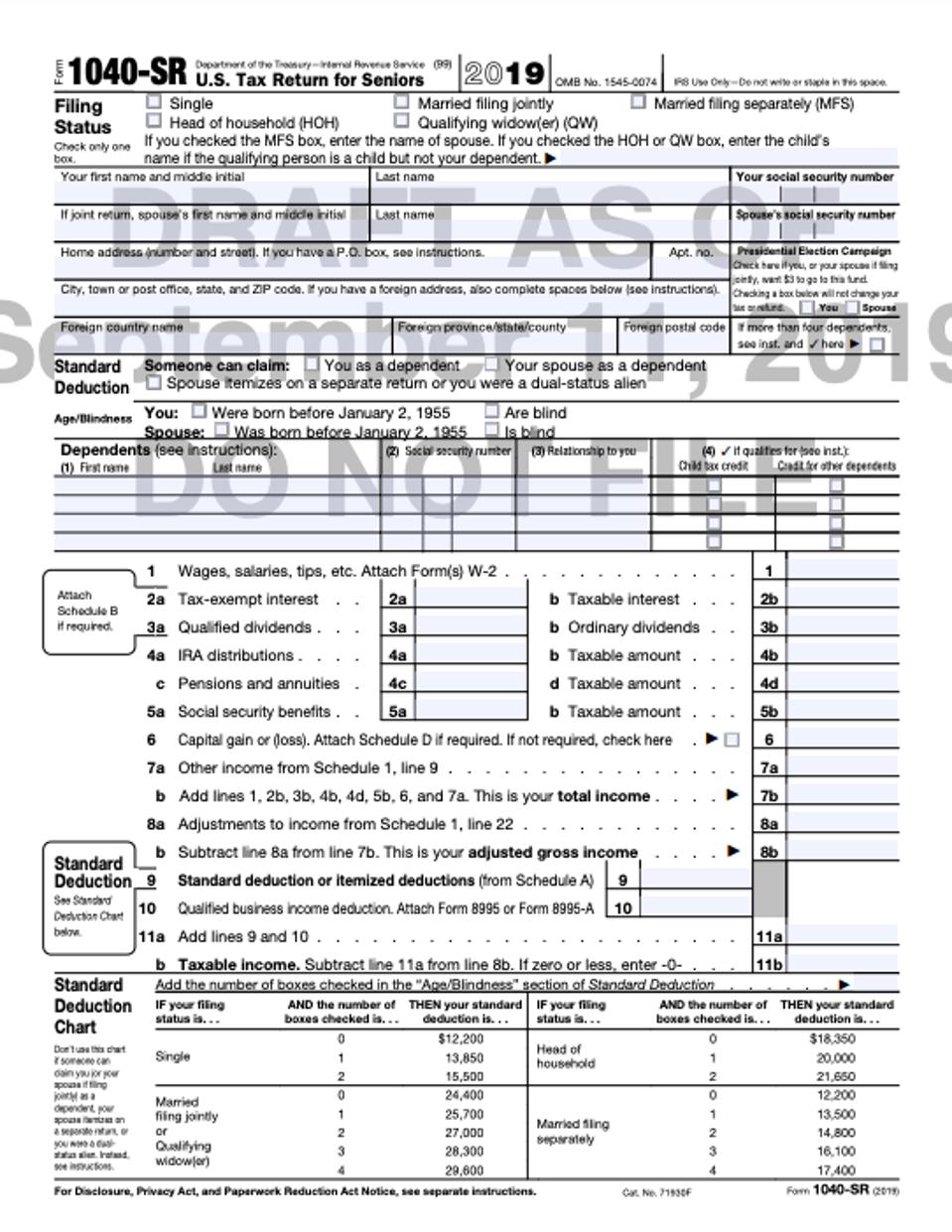

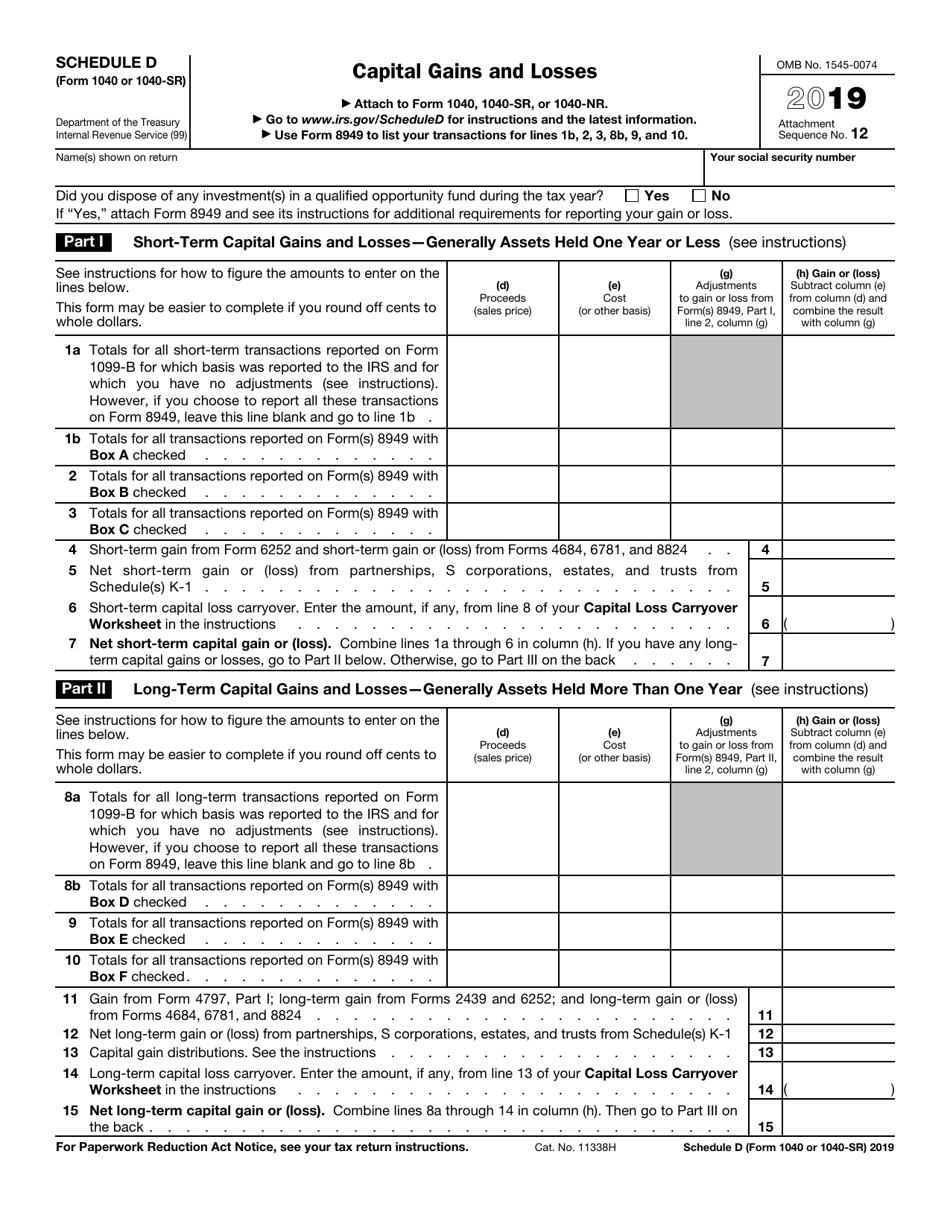

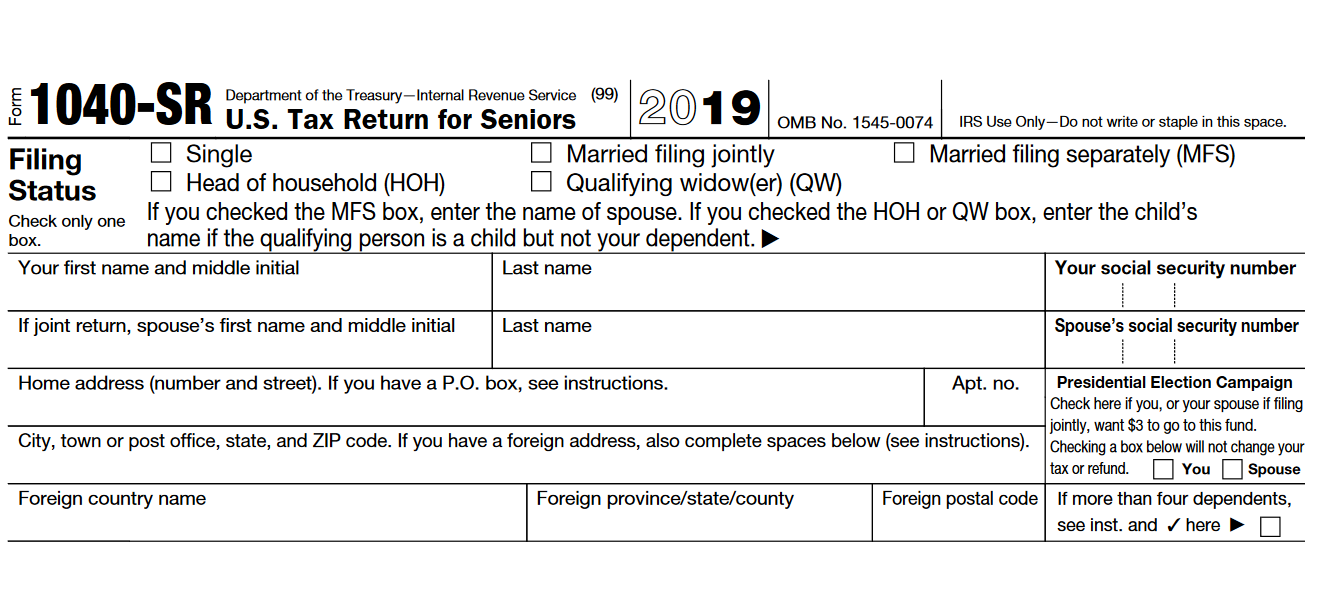

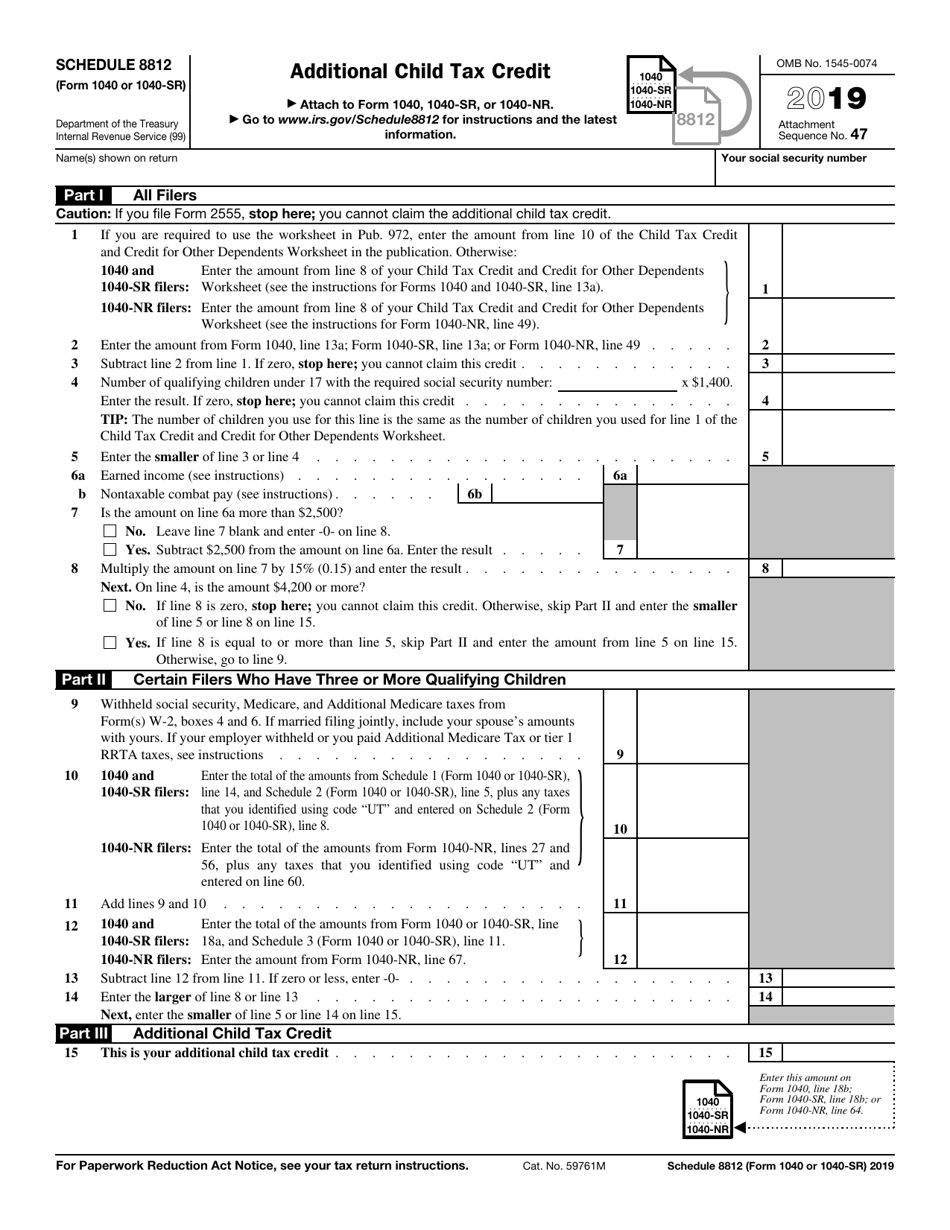

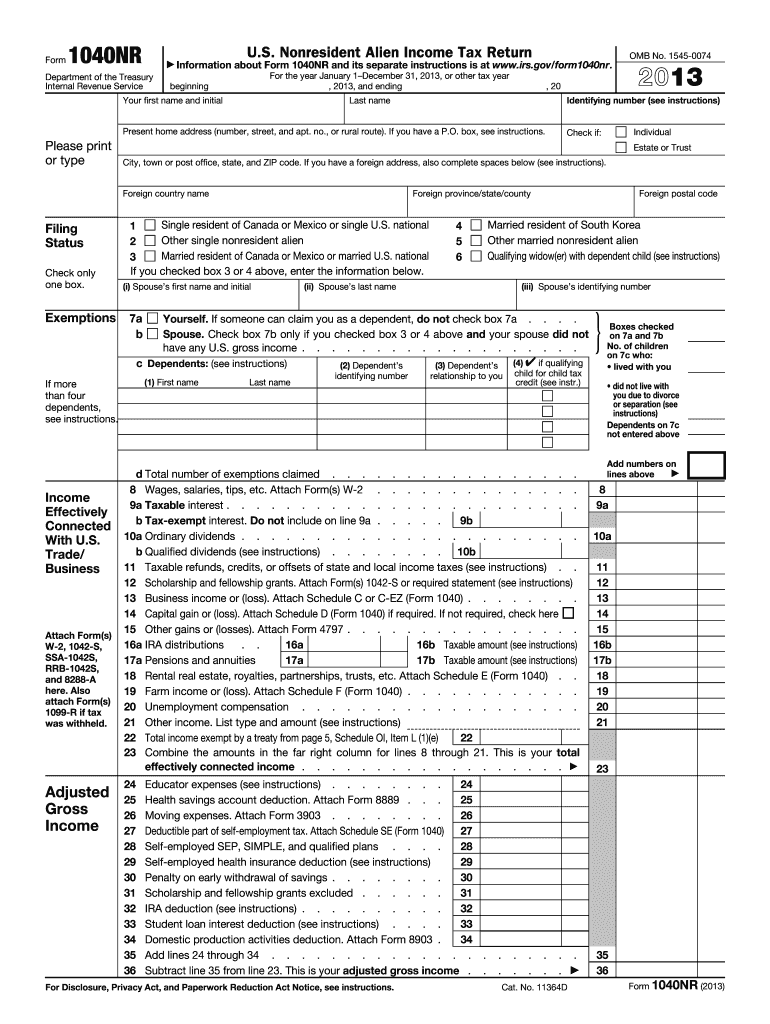

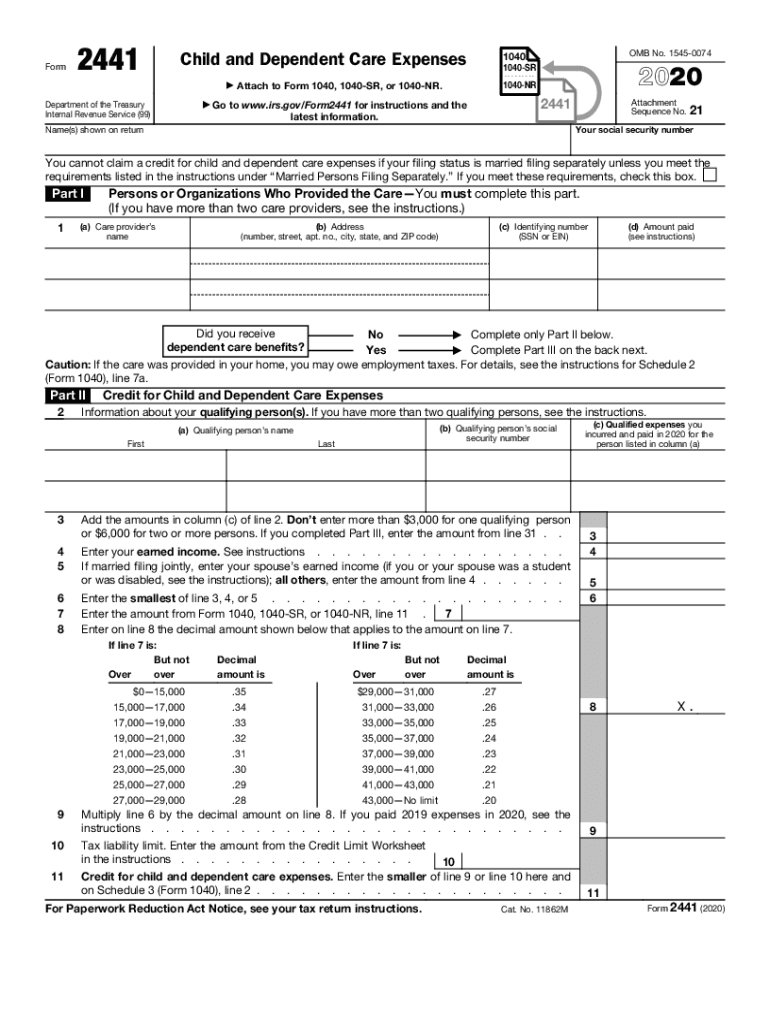

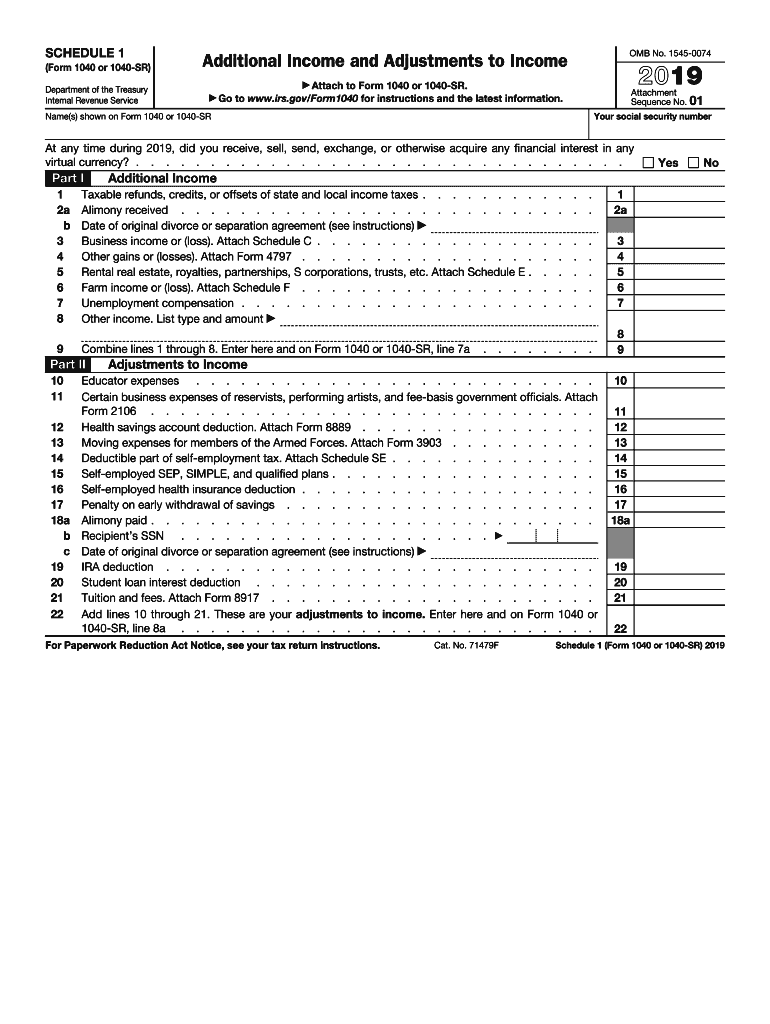

Printable 1040 Sr - Standard deduction for seniors over 65. The internal revenue service (irs) has introduced the. If line 4 is over $1,500, you must complete part iii. Tax return for seniors” could make filing season a bit less taxing for some older taxpayers — provided. Calculate over 1,500 tax planning strategies automatically and save tens of thousands If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. It has bigger print, less shading, and features. Web most us resident taxpayers will file form 1040 for tax year 2022. Web any us resident taxpayer can file form 1040 for tax year 2021. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Irs use only—do not write or staple in this space. It has bigger print, less shading, and features. Ad download, print or email irs 1040 tax form on pdffiller for free. 1040 form, get ready for tax deadlines by filling online any tax form for free. Web get federal tax return forms and file by mail. Irs use only—do not write or staple in this space. Click the fill out form button to start the filling process. Fill out your and your spouse's. 1040 form, get ready for tax deadlines by filling online any tax form for free. Irs use only—do not write or staple in. Web published january 21, 2020. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Fill out your and your spouse's. Detailed instructions for the tax return for seniors with examples. It has bigger print, less shading, and features. Web subtract line 3 from line 2. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. If line 4 is over $1,500, you must complete part iii. Web most us resident taxpayers will file form 1040 for tax year 2022. Irs use only—do not write or staple in. The short form 1040a and easy form 1040ez have been discontinued by the irs. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Click the fill out form button to start the filling process. Web get federal tax return forms and file by mail. Ad tax plan at both the federal and state levels with over 1,500. Irs use only—do not write or staple in. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. Irs use only—do not write or staple in this space. Web the irs has released a new tax filing form for people 65 and older. Standard deduction for seniors over 65. Department of the treasury—internal revenue service. Web subtract line 3 from line 2. The short form 1040a and easy form 1040ez have been discontinued by the irs. Web most us resident taxpayers will file form 1040 for tax year 2022. 1040 form, get ready for tax deadlines by filling online any tax form for free. Web any us resident taxpayer can file form 1040 for tax year 2021. The internal revenue service (irs) has introduced the. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Department of the treasury—internal revenue service. Standard deduction for seniors over 65. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web subtract line 3 from line 2. The internal revenue service (irs) has introduced the. Irs use only—do not write or staple in this space. Web any us resident taxpayer can file form 1040 for tax year 2021. Tax return for seniors” could make filing season a bit less taxing for some older taxpayers — provided. Standard deduction for seniors over 65. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. It has bigger print, less shading, and features. Filing the 1040 tax form online. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Department of the treasury—internal revenue service. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. Tax return for seniors” could make filing season a bit less taxing for some older taxpayers — provided. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Standard deduction for seniors over 65. Fill out your and your spouse's. Detailed instructions for the tax return for seniors with examples. Web the irs has released a new tax filing form for people 65 and older. Ad download, print or email irs 1040 tax form on pdffiller for free. Part ii ordinary dividends (see. 1040 form, get ready for tax deadlines by filling online any tax form for free. Filing the 1040 tax form online. Irs use only—do not write or staple in this space. Web subtract line 3 from line 2. If line 4 is over $1,500, you must complete part iii. The internal revenue service's new “u.s. The internal revenue service (irs) has introduced the. It has bigger print, less shading, and features.IRS Form 1040 (1040SR) Schedule D 2019 Fill Out, Sign Online and

Form 1040 SR Should You Use It For Your 2019 Tax Return 2021 Tax

form 1040 sr printable Schedule 1040 form irs printable fillable

1040SR What you need to know about the new tax form for seniors

Irs Fillable Form 1040 Form 1040 Sr U S Tax Return For Seniors Definition

Form 2441 Fill Out and Sign Printable PDF Template signNow

1040SR What you need to know about the new tax form for seniors

Irs Fillable Form 1040 IRS Form 1040 (1040SR) Schedule 1 Download

Form 1040SR Seniors Get a New Simplified Tax Form

IRS Offers New Look At Form 1040SR (U.S. Tax Return for Seniors)

Related Post:

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)