Kansas W2 Form Printable

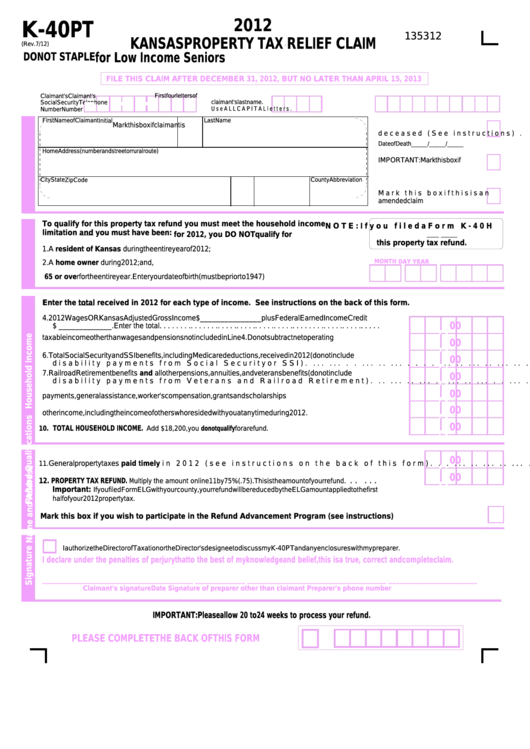

Kansas W2 Form Printable - Will you work with me to make sure my. Using the information from your. The amount of tax withheld should be reviewed each year and new. Many of the forms will provide options such as mail, fax or upload to the portal. Form below, sign it and provide it to your employer. Personal allowance worksheet, complete the. If your employer does not. Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year. Enter the total kansas income tax withheld from all. Web when you're ready to submit the form (s) please select one of the options indicated on the form. Personal allowance worksheet, complete the. Enter the total kansas income tax withheld from all. Using the information from your. Web when you're ready to submit the form (s) please select one of the options indicated on the form. Even if you aren’t required to file electronically, doing so. If too little is withheld, you will generally owe tax when. If your employer does not. Even if you aren’t required to file electronically, doing so. Ks learning & performance management; Many of the forms will provide options such as mail, fax or upload to the portal. Enter the total kansas income tax withheld from all. Even if you aren’t required to file electronically, doing so. Using the information from your. If your employer does not. Will you work with me to make sure my. Using the information from your. If too little is withheld, you will generally owe tax when. Ks learning & performance management; Enter the total kansas income tax withheld from all. Will you work with me to make sure my. Web when you're ready to submit the form (s) please select one of the options indicated on the form. Using the information from your. Form below, sign it and provide it to your employer. Where can i find more information about filing requirements? Ks learning & performance management; Even if you aren’t required to file electronically, doing so. Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year. Will you work with me to make sure my. Ks learning & performance management; If too little is withheld, you will. Web when you're ready to submit the form (s) please select one of the options indicated on the form. The amount of tax withheld should be reviewed each year and new. Will you work with me to make sure my. Many of the forms will provide options such as mail, fax or upload to the portal. Form below, sign it. Web when you're ready to submit the form (s) please select one of the options indicated on the form. Ks learning & performance management; The amount of tax withheld should be reviewed each year and new. Even if you aren’t required to file electronically, doing so. Where can i find more information about filing requirements? Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year. Where can i find more information about filing requirements? Form below, sign it and provide it to your employer. Even if you aren’t required to file electronically, doing so. If too. Form below, sign it and provide it to your employer. Web when you're ready to submit the form (s) please select one of the options indicated on the form. If your employer does not. Where can i find more information about filing requirements? Click on any header in the table below to sort the forms by that topic, or use. If too little is withheld, you will generally owe tax when. Many of the forms will provide options such as mail, fax or upload to the portal. If your employer does not. The amount of tax withheld should be reviewed each year and new. Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year. Will you work with me to make sure my. Ad fast, easy & secure. Web when you're ready to submit the form (s) please select one of the options indicated on the form. Enter the total kansas income tax withheld from all. Using the information from your. Ks learning & performance management; Where can i find more information about filing requirements? Personal allowance worksheet, complete the. Even if you aren’t required to file electronically, doing so. Form below, sign it and provide it to your employer.printable w2 forms for That are Tactueux Harper Blog

Kansas W2 Form Printable

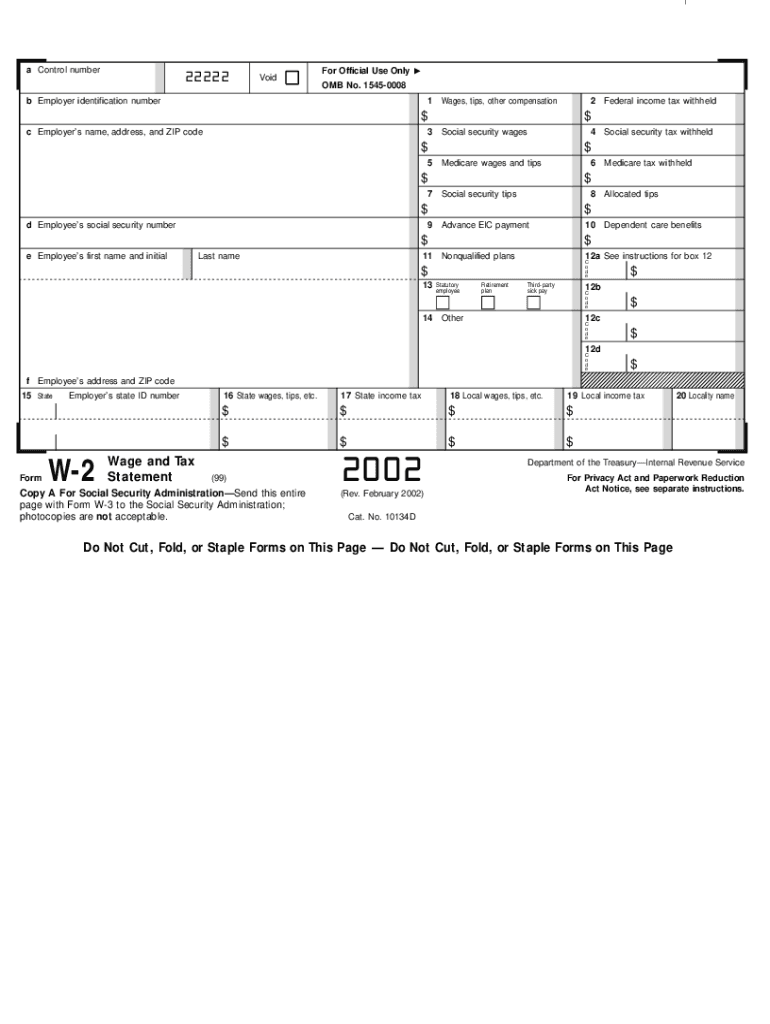

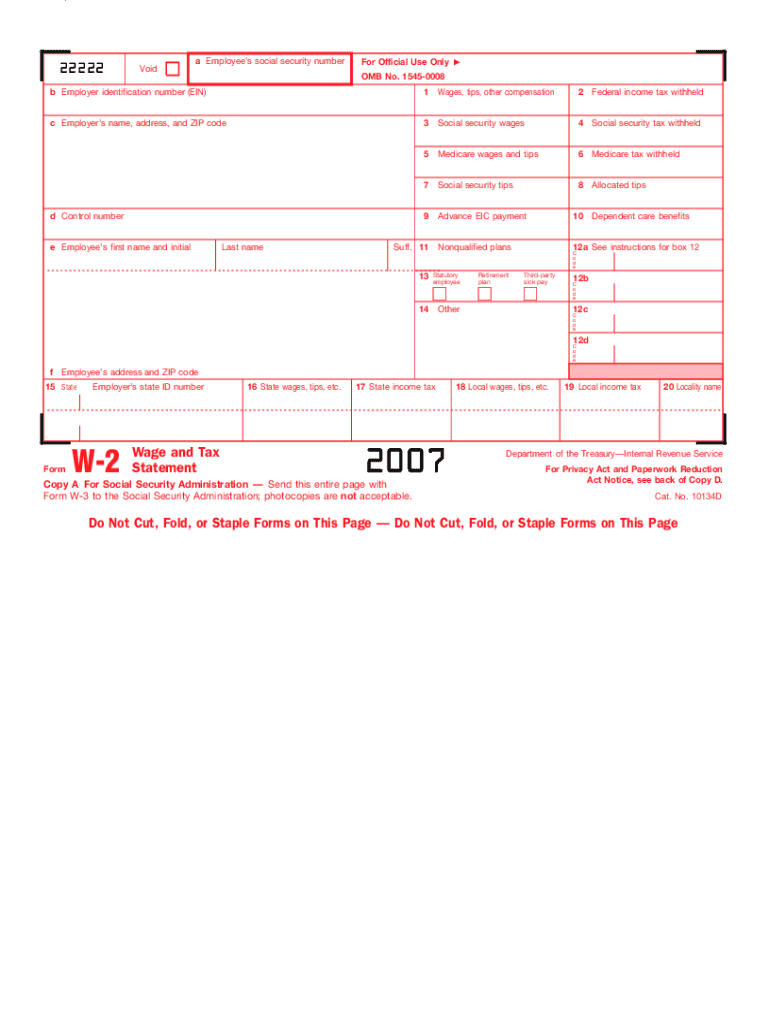

2002 Form IRS W2Fill Online, Printable, Fillable, Blank pdfFiller

Kansas W2 Form Printable

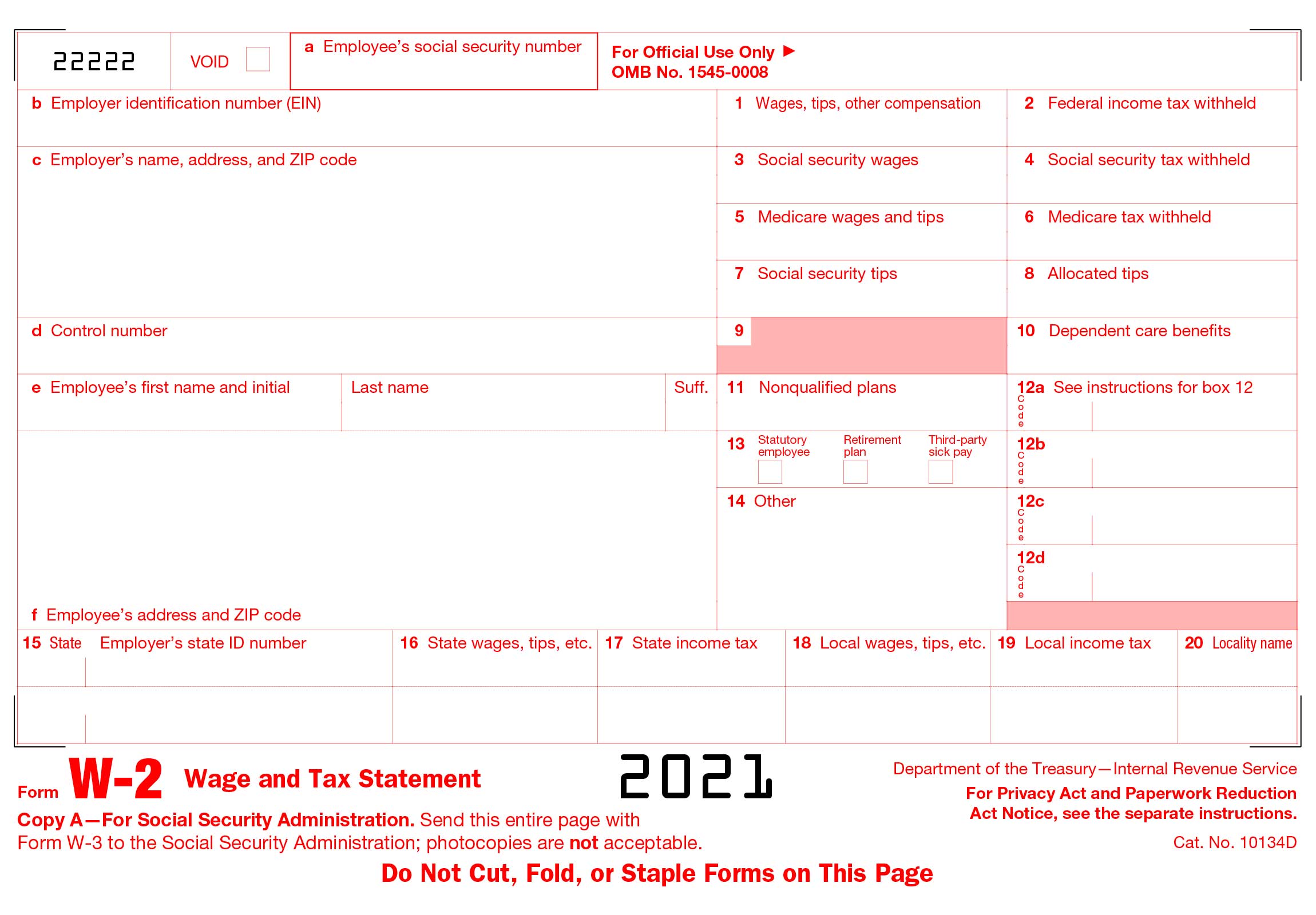

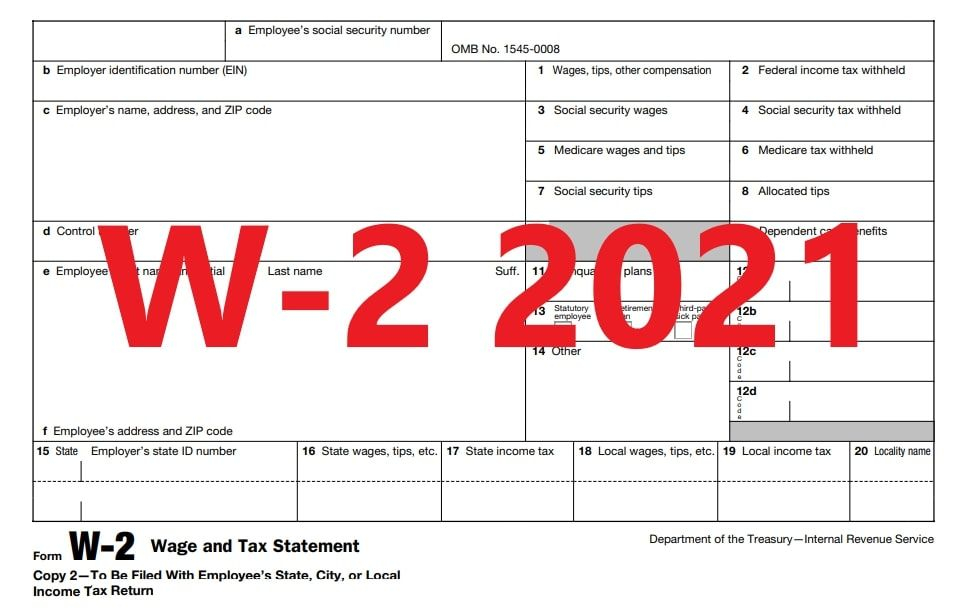

Free Printable W2 Form 2021 Printable Form, Templates and Letter

What Is Form W2? An Employer's Guide to the W2 Tax Form Gusto

Kansas W2 Form Printable

Printable W 2 Form 2021 Printable Form 2022

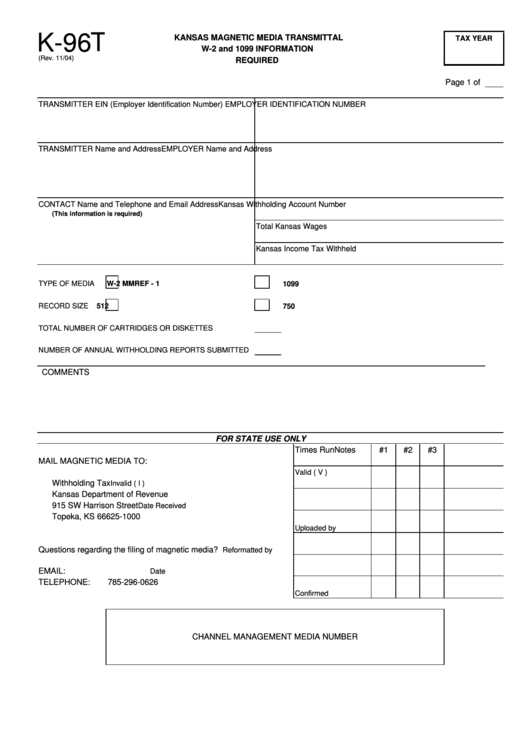

FormsAndChecks Help page State List W2 and 1099 forms

W2 Form Fill Out and Sign Printable PDF Template signNow

Related Post: