Irs Form 9465 Printable

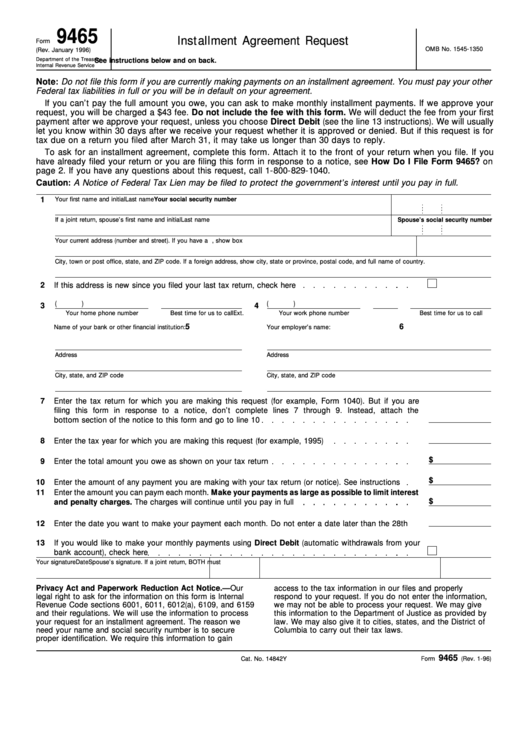

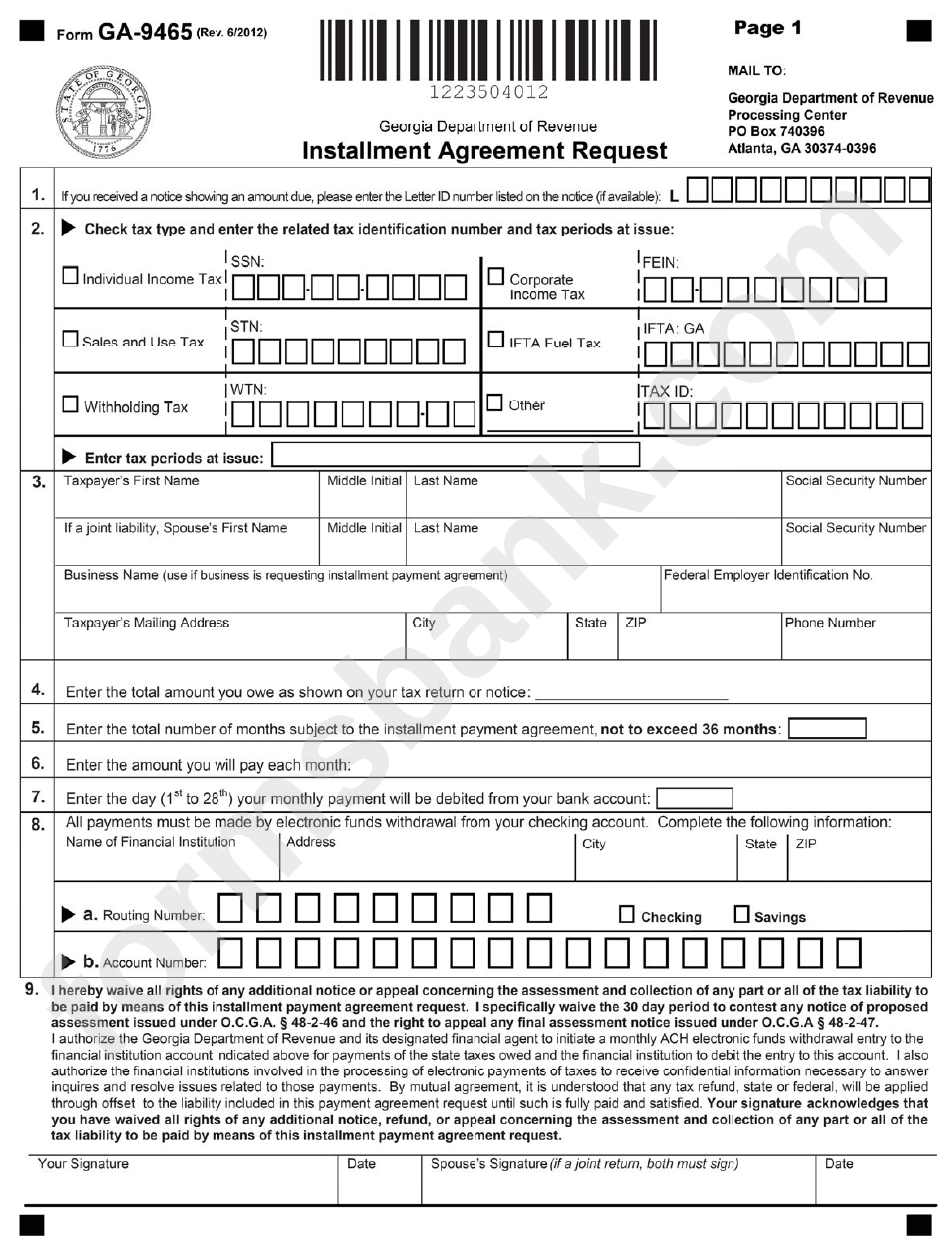

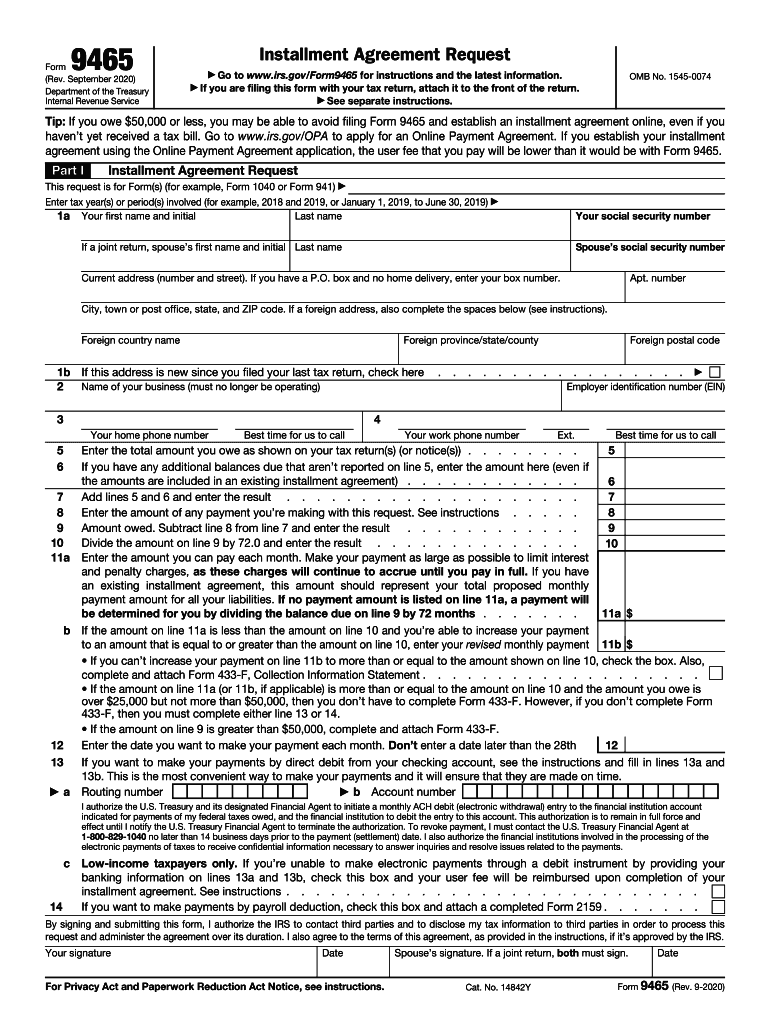

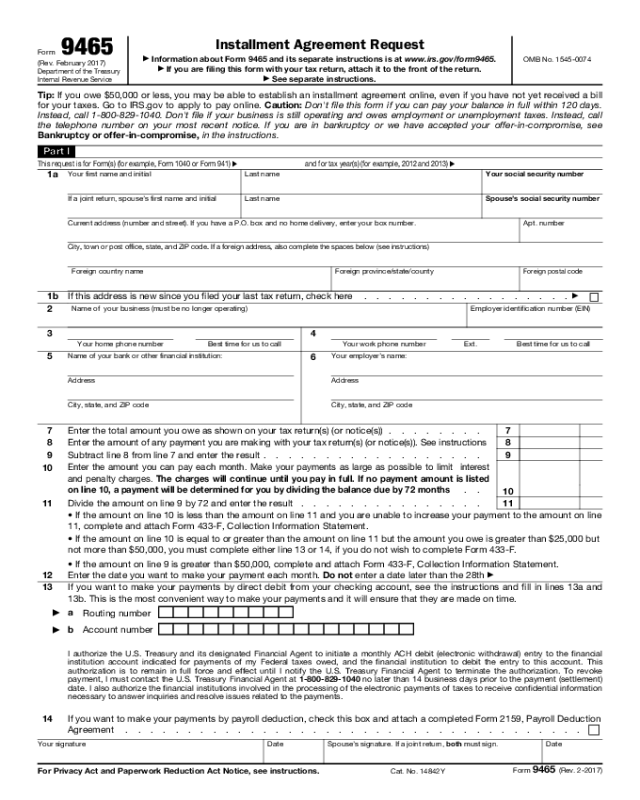

Irs Form 9465 Printable - If you owe $50,000 or less, you may be able to avoid filing form 9465 and establish an installment agreement online,. Form 9465 is available in all versions of taxact ®. Web download or print the 2022 version of the federal form 9465, which is for income earned in tax year 2022, with tax returns due in april 2023. Use form 9465 if you’re an individual: Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web in order to request the installment agreement, you must be unable to pay the tax in full within 120 days of the tax return filing deadline or the date you receive an irs. You can download and print the form or fill it out online using the irs. Upload, modify or create forms. Web you can find irs form 9465 on the official website of the internal revenue service (irs). Ad access irs tax forms. Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. If you owe $50,000 or less, you may be able to avoid filing form 9465 and establish an installment agreement online,. Web internal revenue service see separate instructions. Use form 9465 if you’re an individual: Ad. Web the diff files for the form 9465 identify the changes from the cuv25.1 schema package to the cuv26.0 schema package. Form 2159 prints in triplicate and must be completed by. Upload, modify or create forms. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your. Click the print icon and then click the pdf link. Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. If you owe $50,000 or less, you may be able to avoid filing form 9465 and establish an installment agreement online,. •who is or may be responsible. Click the print icon and then click the pdf link. You can download and print the form or fill it out online using the irs. Web download or print the 2022 version of the federal form 9465, which is for income earned in tax year 2022, with tax returns due in april 2023. Web to print form 9465: Upload, modify. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Complete, edit or. Try it for free now! Use form 9465 if you’re an individual: Online navigation instructions from within your taxact return ( online ), click the print center dropdown, then click custom print. You can download and print the form or fill it out online using the irs. Form 9465 is available in all versions of taxact ®. Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Web the diff files for the form 9465 identify the changes from the cuv25.1 schema package to the cuv26.0 schema package. Web form 9465 installment agreement request (rev. You can download and print the form or fill. Form 9465 is available in all versions of taxact ®. Download this form print this form more about the. If the irs doesn’t approve your installment request: Form 9465 is available in all versions of taxact®. Complete, edit or print tax forms instantly. Try it for free now! Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Complete, edit or print tax forms instantly. Web form 9465 installment agreement request (rev. Web form 9465 is used by taxpayers to. You can download and print the form or fill it out online using the irs. Ad access irs tax forms. Web enter x in this field to fill out form 9465 line 14 and print form 2159, payroll deduction agreement, with form 9465. Upload, modify or create forms. You can download the current version of form 9465 in pdf. Whether you owe federal income. Form 9465 is available in all versions of taxact®. Form 2159 prints in triplicate and must be completed by. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Download this form print this form more about the. Web enter x in this field to fill out form 9465 line 14 and print form 2159, payroll deduction agreement, with form 9465. Web form 9465 installment agreement request (rev. This form is for installment agreements. Complete, edit or print tax forms instantly. •who is or may be responsible for a trust fund recovery. Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save irs payment agreement rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★. Web who should use this form? In the forms and schedules. Web the amount of payment you’re making with the request from form 9465, line 8 will be transmitted as the amount to be withdrawn. Use form 9465 if you’re an individual: Web download or print the 2022 version of the federal form 9465, which is for income earned in tax year 2022, with tax returns due in april 2023. If you owe $50,000 or less, you may be able to avoid filing form 9465 and establish an installment agreement online,. Click the print icon and then click the pdf link. Web in order to request the installment agreement, you must be unable to pay the tax in full within 120 days of the tax return filing deadline or the date you receive an irs.Fill Free fillable IRS PDF forms

Irs form 9465 Fillable 2018 Irs Gov forms Fillable Printable Pdf

Printable Form 9465 Printable Forms Free Online

Form Ga9465 Installment Agreement Request printable pdf download

Irs Power Of Attorney Form Pdf

form_9465_Installment_Agreement_Request Stop My IRS Bill

20202023 Form IRS 9465Fill Online, Printable, Fillable, Blank pdfFiller

IRS Form 9465 Instructions for How to Fill it Correctly

Form 9465 Edit, Fill, Sign Online Handypdf

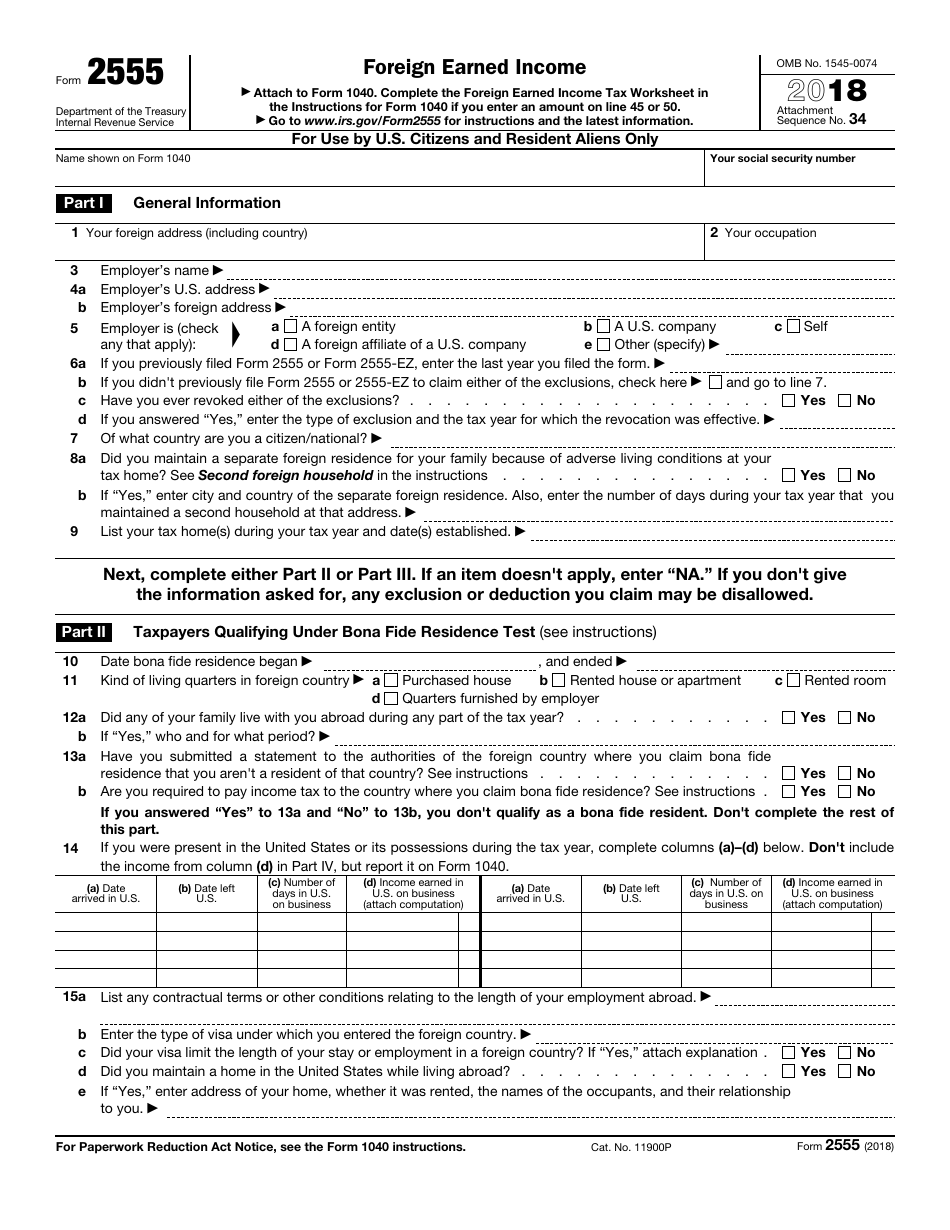

IRS Form 2555 Download Fillable PDF or Fill Online Foreign Earned

Related Post: