1099 Misc Printable Form

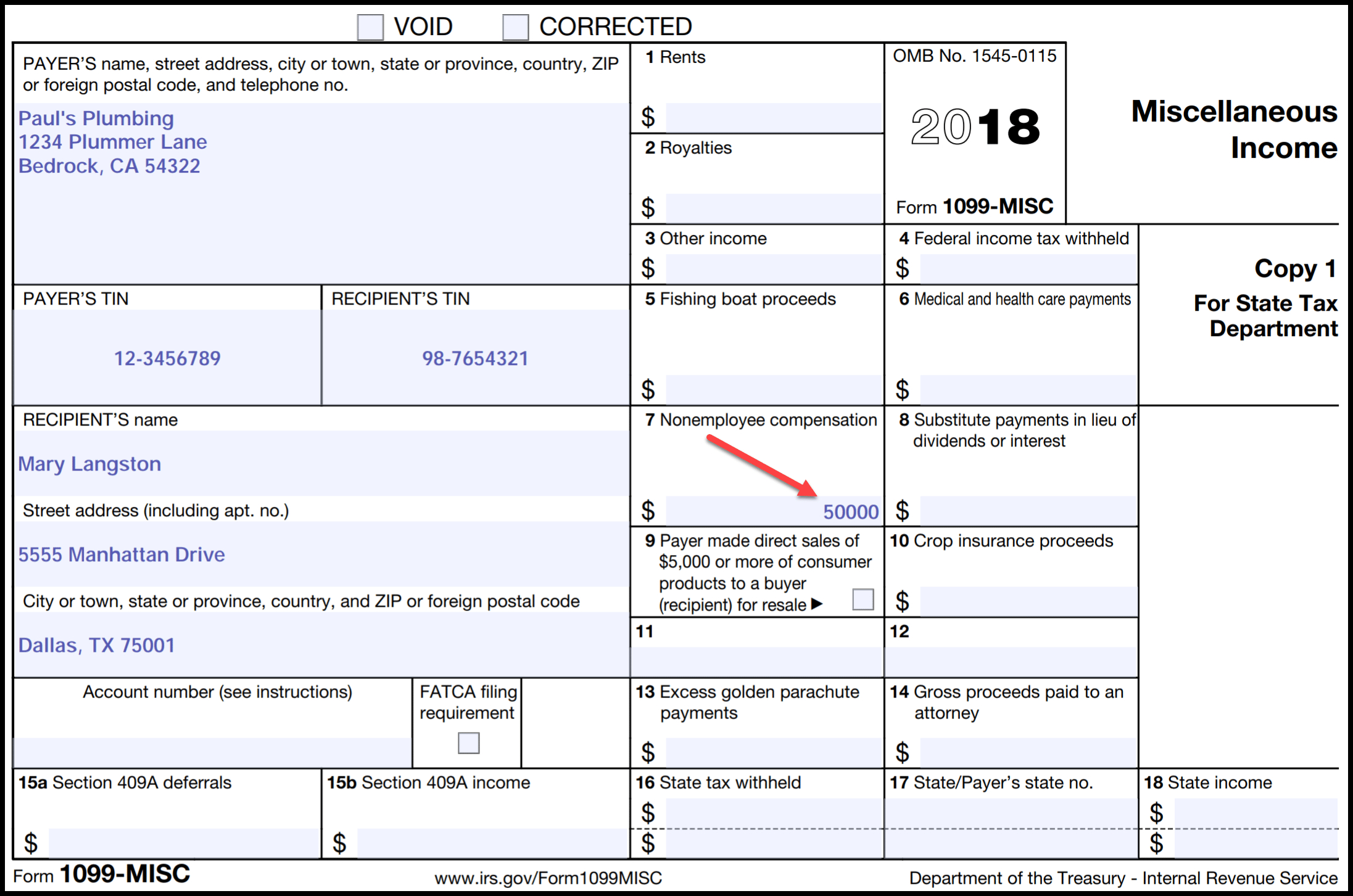

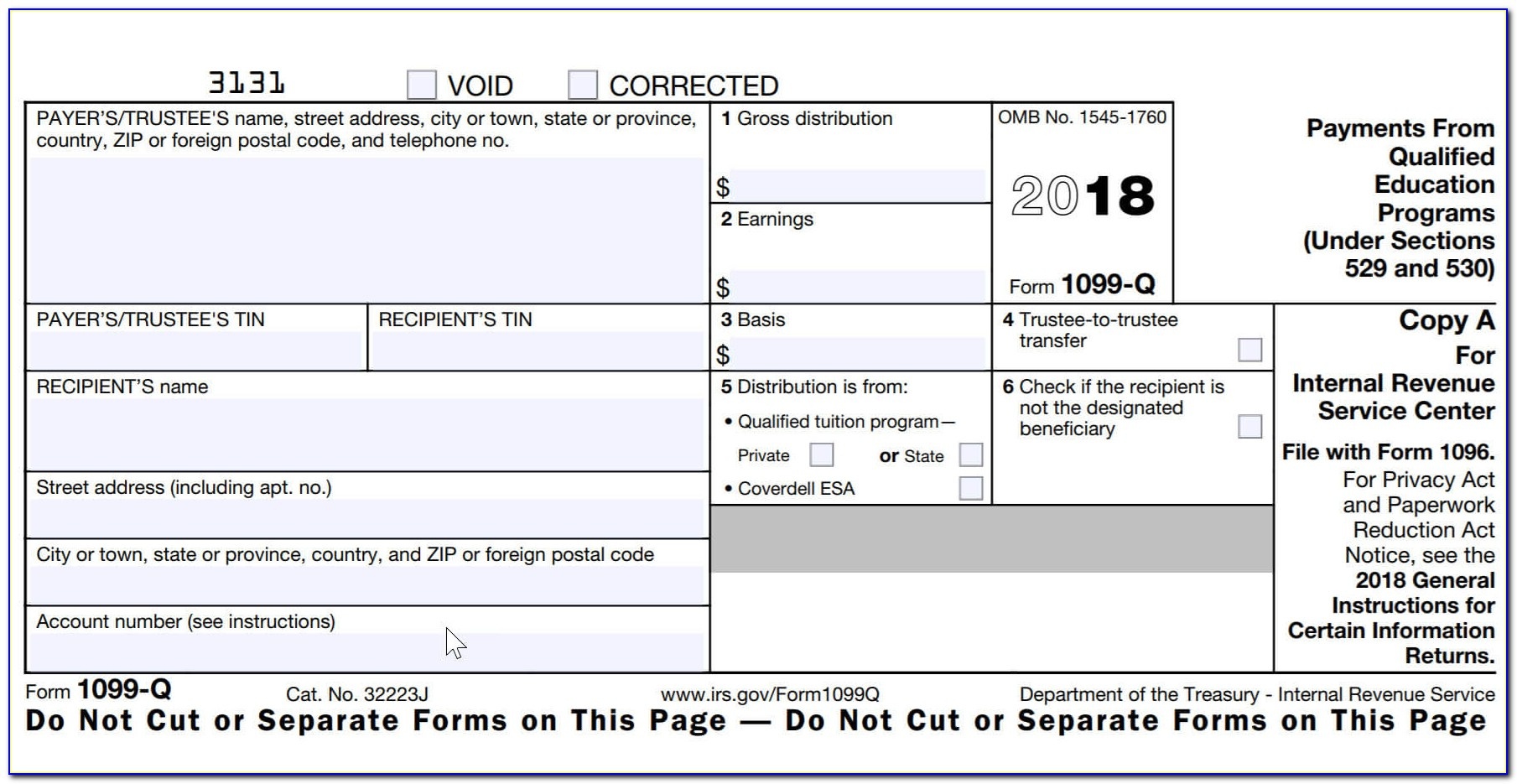

1099 Misc Printable Form - (5 / 5) 115 votes. Updated for tax year 2023 • october 19, 2023 8:58 am. 03 export or print immediately. Fill, edit, sign, download & print. Web updated october 19, 2023. Written by a turbotax expert • reviewed by a turbotax cpa. Payments above a specified dollar. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. Click now on add row and make the. Fill, edit, sign, download & print. Web print and file copy a downloaded from this website; For your protection, this form may show only the last four digits of your. Includes 3 1096 summary transmittals. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. For your protection, this form may show only the last four digits of your. Updated for tax year 2023 • october 19, 2023 8:58 am. Web use form 1099 misc to report miscellaneous income to the irs and recipients; A penalty may be imposed for filing with the irs. Recipient’s taxpayer identification number (tin). The most popular type is a 1099 misc form. Written by a turbotax expert • reviewed by a turbotax cpa. Payments above a specified dollar. (5 / 5) 115 votes. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Written by a turbotax expert • reviewed by a turbotax cpa. 01 fill and edit template. 03 export or print immediately. Web print and file copy a downloaded from this website; Recipient’s taxpayer identification number (tin). Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web print and file copy a downloaded from this website; Click now on add row and make the. The most popular type is a 1099 misc form. Do not miss the deadline A penalty may be imposed for filing with the irs. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Ad get the latest 1099 misc online. Click now on add row and make the. Includes 3 1096 summary transmittals. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. Fill, edit, sign, download & print. Payments above a specified dollar. Web updated october 19, 2023. Recipient’s taxpayer identification number (tin). Ad get the latest 1099 misc online. Web updated october 19, 2023. Written by a turbotax expert • reviewed by a turbotax cpa. (5 / 5) 115 votes. Updated for tax year 2023 • october 19, 2023 8:58 am. Web in common words a 1099 form reports all income earnings, dividends, payments, and other personal income. Payments above a specified dollar. Web updated october 19, 2023. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. 01 fill and edit template. Do not miss the deadline Web updated october 19, 2023. Ad get the latest 1099 misc online. Includes 3 1096 summary transmittals. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of. Web print and file copy a downloaded from this website; 01 fill and edit template. For internal revenue service center. Fill, edit, sign, download & print. The most popular type is a 1099 misc form. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Written by a turbotax expert • reviewed by a turbotax cpa. Includes 3 1096 summary transmittals. Updated for tax year 2023 • october 19, 2023 8:58 am. Click now on add row and make the. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Payments above a specified dollar. Web use form 1099 misc to report miscellaneous income to the irs and recipients; Web updated october 19, 2023. Recipient’s taxpayer identification number (tin). Do not miss the deadline 03 export or print immediately. (5 / 5) 115 votes. Web in common words a 1099 form reports all income earnings, dividends, payments, and other personal income. A penalty may be imposed for filing with the irs.1099MISC Form Printable and Fillable PDF Template

Printable 1099 Misc Tax Form Template Printable Templates

1099MISC 3Part Continuous 1" Wide Formstax

What is a 1099Misc Form? Financial Strategy Center

6 mustknow basics form 1099MISC for independent contractors Bonsai

Form 1099MISC Miscellaneous Definition

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

Free Printable 1099 Misc Forms Free Printable

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

1099 Misc Printable Template Free Printable Templates

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)